The Pandemic Aggravated Racial Inequalities in Housing Insecurity: What Can it Teach Us About Housing Amidst Crises?

During the pandemic, as lockdowns to reduce the spread of COVID-19 prompted widespread loss of work, millions of renters and homeowners fell behind on their housing payments. In our new article “COVID-19 and Racial Inequalities in Housing: Pre-Pandemic and Pandemic Pathways to Housing Insecurity,” published in the Journal of Urban Affairs, we show how Black, Hispanic, and Asian households disproportionally fell behind on housing payments during the pandemic. Using this as our measure of housing insecurity, we found that the higher likelihood of having late payments were partially a byproduct of pre-pandemic inequalities, but the systemic shock of the pandemic aggravated existing racial and ethnic disparities.

Analyzing data from the Household Pulse Survey, a nationally representative survey by the US Census Bureau, we found that Black (23 percent), Hispanic (18 percent), and Asian (15 percent) households were far more likely than white households (8 percent) to fall behind on housing payments between August and December 2020. Black renters were most vulnerable, with one in four Black renters (26 percent) reporting being behind on rent.

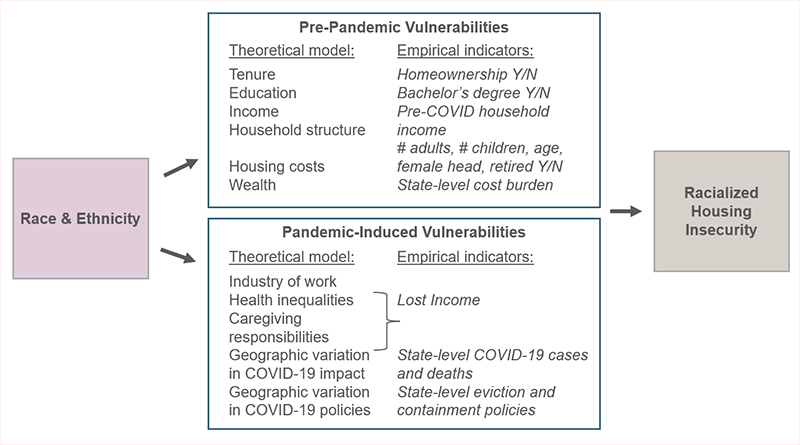

Higher rates of housing insecurity for households of color were partially a byproduct of racial disparities that preceded the pandemic, such as lower homeownership rates, incomes, and education levels. For example, 66 percent of white households in our sample owned their homes, compared to 46 percent of Hispanic and 39 percent of Black households. However, the pandemic itself also shaped new inequalities in who became vulnerable to housing insecurity due to differences in who worked in the most-impacted industries, underlying health disparities, and the geographic variation in COVID-19 (Figure 1). Indeed, our research highlights how broader social crises like pandemics, recessions, political turmoil, or climate disasters, what we call systemic shocks, have the potential to disrupt existing patterns of social stratification and tend to exacerbate those inequities.

Figure 1: Pre-Pandemic and Pandemic-Induced Vulnerabilities Both Shaped Racial Inequalities in Housing Insecurity

Specifically, we found that Black and Hispanic households were far more likely to suffer from the financial fallout of the pandemic. Indeed, more than half of Black and Hispanic households lost employment income at some point between March 2020 and the end of the year compared to about two-fifths of white households. Moreover, we found that Black and Hispanic households were more likely to fall behind on their rent or mortgage payments in the aftermath of losing employment income. In the paper, we used regression models to better understand how changes in some characteristics (such as losing employment income) were associated with a households’ ability to keep up with their housing payments while controlling for other characteristics. For our purposes, these methods are important because they allow us to account for other differences that exist by race and ethnicity (like pre-pandemic vulnerabilities) that also influence the likelihood a household fell behind on their payments.

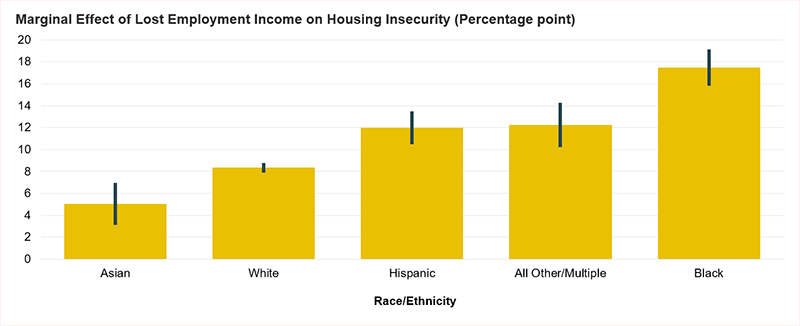

Predictions from these models suggest that a Black household with lost employment income and otherwise average characteristics would have a 28 percent chance of falling behind on their payments, 18 percentage points higher than those who did not lose employment income (Figure 2). By comparison, we predicted a 12 percentage point increase in housing insecurity for Hispanic, 8 percentage point increase for white, and 5 percentage point increase for Asian households with lost employment income. In other words, not only were Black and Hispanic households more likely to lose employment income in the second half of 2020, but they were significantly more likely to face housing insecurity when they lost income.

Figure 2: After Losing Income, Black Households Were More Likely to Become Housing Insecure than Other Groups

Our work carries key implications for policymakers. During the pandemic, numerous policies were enacted—including expanded eviction protections and mortgage forbearance—that successfully kept millions of people in their homes. But even with these successes, we still observed large racial disparities in housing insecurity as such programs did little to rectify pre-existing racial gaps and the ways that the pandemic shaped racialized vulnerabilities. Policies designed to help respond to future crises should account for these disparities, as moments of crisis like a pandemic, recession, or climate disaster often reproduce or exacerbate unequal housing outcomes. Moreover, while we need to address existing inequalities in housing, doing so would also create a more resilient housing system capable of withstanding future systemic shocks.