Findings and Lessons from Two National Surveys of Landlords

The COVID-19 pandemic has resulted in profound economic hardship for the nation’s renters; the most recent Census Bureau Household Pulse Survey found that nearly 8 million renters were behind on rent. While there is significant concern about whether these distressed renters will be able to stay stably housed, missed rental payments also have implications for the nation’s landlords. But much less is known about how property owners have fared and how they have responded to this significant shortfall in rent collections.

Helping to fill this information void, two recent national surveys provide valuable information about rental owners and how the pandemic has impacted their financial circumstances and property management practices: one published by the Joint Center for Housing Studies (JCHS), the other by UC Berkeley’s Terner Center for Housing Innovation. In “The Impact of the Pandemic on Landlords: Evidence from Two National Surveys,” a new study published as part of the Housing Crisis Research Collaborative, we synthesize (along with our co-authors Nathaniel Decker and Elijah de la Campa) findings from these two papers and highlight policy implications for both current and long-term efforts to support renters and stabilize rental markets through times of financial crisis.

While distinct in certain respects, the two studies were coordinated to facilitate a comparison of results. Both surveys were designed to explore the pandemic’s impact across different types of landlords, properties, and rental markets by asking owners a series of questions about rental collection, profitability, and management practices, both pre- and post-pandemic. The JCHS study surveyed landlords in 10 large cities drawing on information from rental registries and/or landlords who participated in emergency rental programs. The Terner Center study focused on the owners of small rental properties (1- to 4-unit buildings, also referred to as single-family rentals) in the cities and suburbs of large and mid-sized metros. The surveys predominantly capture non-professional landlords with race, age, and income profiles similar to those reporting rental income in the Current Population Survey, although respondents to the JCHS study had a higher share of landlords of color, perhaps reflecting the focus on properties in central cities.

Both surveys find sizeable impacts on rent collections during the pandemic and document shifts in management practices that suggest policy interventions helped curtail an increase in evictions, at least temporarily

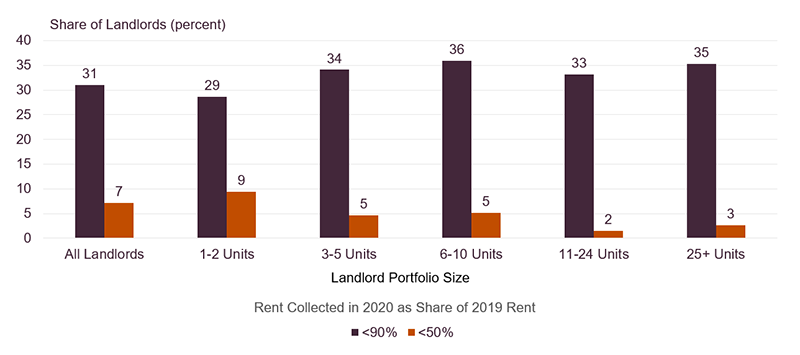

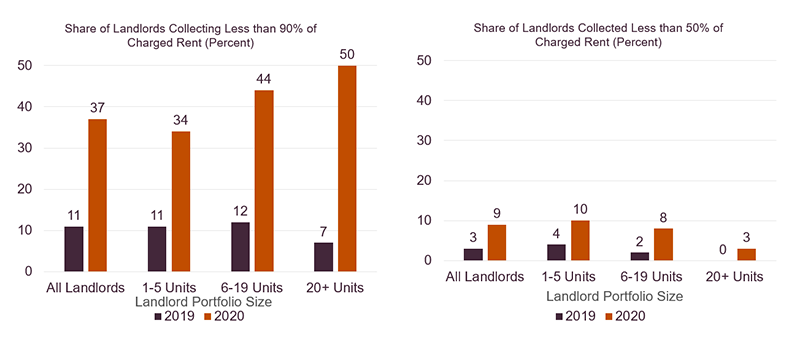

The findings of the two studies—both fielded in early 2021—were consistent. Roughly a third of landlords reported declines in rent collection during the pandemic, although smaller-scale landlords reported more substantial losses (Figures 1a and 1b).

Figure 1a: Landlord Rent Shortfalls (Terner Center)

Figure 1b: Landlord Rent Shortfall (JCHS)

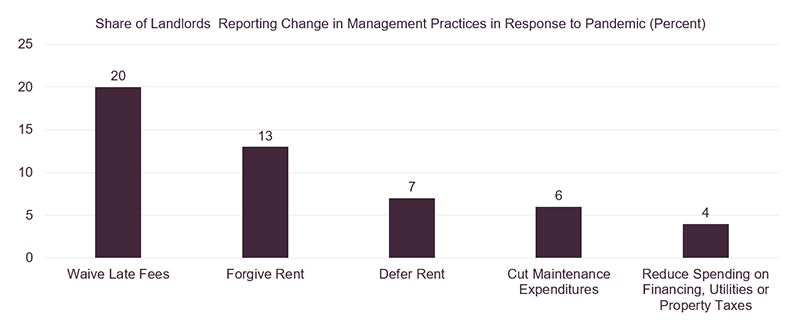

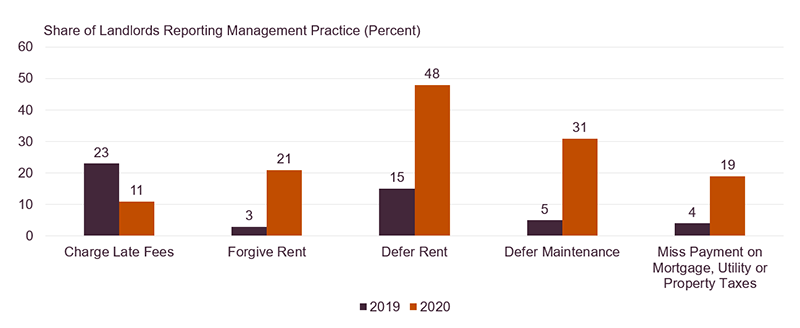

Partly in response to the loss of income, landlords were more likely to grant concessions to tenants, defer maintenance, and reduce payments for debt and other expenses during the pandemic compared to a year earlier (Figures 2a and 2b). However, the JCHS study found that even after controlling for a greater shortfall in rent, landlords were still more likely to exhibit changed behavior toward tenants. These results provide evidence that the public policies implemented in the wake of the pandemic influenced landlord management practices to help stabilize tenants.

Figure 2a: Share of Landlords Reporting Changes in Management Practices During the Pandemic (Terner Center)

Figure 2b: Landlord Management Practices Before and During the Pandemic (JCHS)

Encouragingly, both studies found that only a relatively small share of landlords indicated they were likely to pursue evictions of tenants behind on rent. The JCHS study found that 23 percent of landlords reported pursuing eviction of delinquent tenants in 2020, down from 29 percent in 2019. However, shares were higher in lower-income neighborhoods and areas where the majority of residents were people of color—where landlords were also less likely to offer tenants concessions—signaling the disparate impact of the pandemic on these tenants and communities.

The Terner Center study similarly found that less than one in five landlords expected to pursue eviction against tenants with missed rent, although the share rose to 70 percent in instances where renters were behind 6 months or more. This suggests that in addition to rental assistance, mediation and counseling supports are needed to address deep arrearages where landlord-tenant relationships have been frayed.

Increases in financial stress among landlords may have longer term implications for the availability and quality of naturally affordable rental stock

Both surveys find that the financial stress from the pandemic has increased owners’ interest in selling their properties. Results for this question were identical, with each study finding that the share of owners taking steps to sell their properties rose from 3 percent in 2019 to 13 percent during the pandemic. Combined with an increase in landlords that have deferred maintenance or missed payments for mortgages, utilities, or property taxes, the increase in the share of landlords looking to sell their properties illustrates how the pandemic could reduce the supply of naturally affordable housing stock. Taken together, the surveys underscore the importance of rental supports, not just to stabilize tenants but also to stabilize the properties in which they live.

As of early 2021, a minority of landlords with delinquent tenants had benefited from emergency rental assistance, highlighting that more landlord outreach is needed to deliver this important support to aid tenants and landlords alike

The studies also confirmed that—at least as of early 2021—a minority of landlords had tenants who had benefited from emergency rental assistance. In the JCHS study, 42 percent of landlords with a delinquent tenant had received assistance, while the share was one in three in the Terner Center study. Both studies also found that landlords owning fewer properties were less likely to participate in or be aware of rental assistance programs. Given the importance of rent assistance to stabilize both tenants and properties, it is clear that more effective efforts are needed to reach both landlords and tenants.

More comprehensive and timely data is needed about rental property financial conditions, management practices, and ownership characteristics

Finally, these studies demonstrate the value of data on landlord financial conditions and management practices. Given the importance of good quality, stable housing for the nation’s 43 million renters, there is a compelling case for expanded and more timely efforts to gather information on rental properties and their owners, and provide broader access to administrative data. Crafting programs and policies that are effective, both in times of crisis and over the longer term, requires understanding conditions and trends in this vitally important market.