What Effects Will the Recent Surge in Immigration Have on Household Growth?

After a slowdown during the pandemic-related closures of 2020, immigration levels surged in 2022 and 2023. The Congressional Budget Office estimated that 2.7 million people immigrated to the country in 2022, rising to 3.3 million in 2023, far outpacing the 900,000-person annual average in the 2010s. As we discussed in our recently released State of the Nation’s Housing report, these new arrivals are already having an impact on the housing market, but their full effect on household growth will take some time to be fully realized. Projecting the number of new households from the estimated 6 million new immigrants is difficult given the lack of full demographic information, but considering what is known about these new arrivals, alongside historical data, enables a clearer view of effects on household formation.

The immigration surge’s impact on household growth will be determined by the headship rate—the share of adults who are heading their own household (i.e. ‘householders’)—of the new arrivals. In 2022, 34 percent of working-age immigrants who had arrived within the previous five years were householders, according to American Community Survey (ACS) data. Headship rates among immigrants, however, rise with time in the country. The headship rate of working-age immigrants who arrived earlier (from 2013–2017) and had more time to establish themselves was 41 percent in 2022, while those in the country for 20 years or more had a headship rate higher even than native-born adults, at 50 percent (Figure 1).

Figure 1: Immigrants’ Headship Rates Grow with Time in Country

Source: JCHS tabulations of US Census Bureau, 2022 American Community Survey 1-Year Estimates via IPUMS-USA, University of Minnesota.

Notes: Working-age defined as adults aged 18–64. Immigrants who arrived less than five years before the survey year arrived between 2018–2022. Headship rate is the share of adults who head their own household, otherwise known as householders.

Whether immigrants in the current surge will have the same headship rates as those in recent years depends on their similarity on several key factors that correlate with household formation, including age, country of origin, and immigration status. According to Border Patrol data, there are currently more families with children crossing the Mexico border than in the past. This could mean faster household formation, because headship rates are higher for young adults with children, but it could also mean lower formation overall if there are a larger number of children (who are too young to form households). Headship rates typically rise with age, but the trend is more varied among recently-arrived immigrants. In 2022, immigrants aged 18–24 who had arrived within the past five years had a headship rate of 19 percent, slightly outpacing the same-aged native-born headship rate. This rate is much higher among recently-arrived immigrants aged 25–34 at 36 percent, though that rate sits below the native-born headship rate. Headship rates are higher still among recently-arrived immigrants aged 35–54 but lower among recently-arrived older adults (Figure 2).

Figure 2: Headship Rates Typically Grow with Age but Vary Among Recently-Arrived Immigrants

Source: JCHS tabulations of US Census Bureau, 2022 American Community Survey 1-Year Estimates via IPUMS-USA, University of Minnesota.

Notes: Headship rate is the share of adults who head their own household.

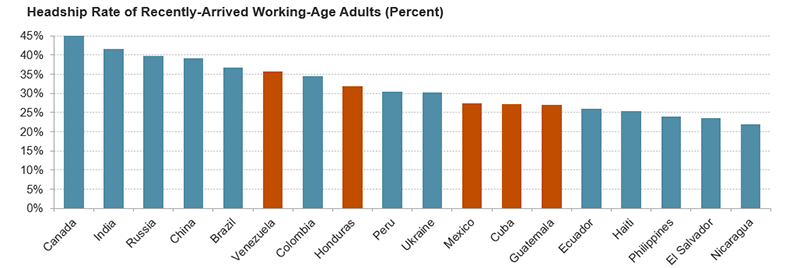

There is also evidence that the current surge is being driven by people from Central and South America, and recent history has shown lower headship rates among immigrants coming from these regions. According to US Customs and Border Protection data, the five most common origins of those encountered at borders nationwide in FY2023 were Mexico, Venezuela, Guatemala, Honduras, and Cuba, with a notable increase among Venezuelans from 2022–2023. The headship rates of recently-arrived immigrants from these countries were typically lower than those from other countries of origin, according to ACS data (Figure 3). In 2022, the headship rates of recently-arrived working-age immigrants from these five countries averaged 30 percent, compared to 34 percent of all recently-arrived immigrants of the same age, and 47 percent of native-born working-age adults. Immigrants from these five countries achieve higher headship rates with time in the country, however, and for immigrants living in the country for 20 years or more, the average headship rate just exceeds that of native-born working-age adults, at 48 percent.

Figure 3: Headship Rates Are Lower Among Recent Immigrants from Most Common Countries of Origin

Sources: JCHS tabulations of US Census Bureau, 2022 American Community Survey 1-Year Estimates via IPUMS-USA, University of Minnesota, and US Customs and Border Protection, FY23 Nationwide Encounters.

Notes: Countries listed represent the citizenship of immigrants with whom CBP reported more than 25,000 border encounters in FY23, with the five highlighted countries having the highest number of encounters. Headship rate is among recently-arrived (within 5 years) working-age (18–64) immigrants by country of origin in 2022.

Another complication for estimating new households is the fact that many of the newly-arrived immigrants are asylum seekers, which has likely delayed or reduced their household formation because of ineligibility to work. The typical asylum process requires those awaiting a decision to apply for a work authorization, which they can receive no sooner than 180 days after their asylum claim was filed. This is important because the headship rate of recently-arrived immigrants in 2022 was 41 percent among employed working-age adults and 27 percent among unemployed working-age adults—and asylum seekers may be in an even more economically difficult situation due to the lack of networks or assets to help them maintain financial footing.

Once more information about the most recent immigrants is available, we will be better able to estimate the extent and timing of their effect on household formation and housing demand. In the meantime, historical data suggests that the millions of new immigrants are likely already having a large impact on household growth and supporting the recent high levels of growth reported in our State of the Nation’s Housing report. Indeed, if the age distribution and age-specific headship rates of the current surge of immigrants are even roughly similar to recent patterns, the estimated 6 million new immigrants could result in well over one million new households over the next five years. Additionally, history suggests that immigrant household formation will grow considerably with time in the country, which could have substantial long-term implications for housing demand and labor markets in the communities where these new households form.