The Continued Growth in Student Loan Debt

Student loan debt has increased substantially over the last two decades, as has the number of households deferring their student loan payments, according to Piling Ever Higher: The Continued Growth of Student Loans, a new research brief released today.

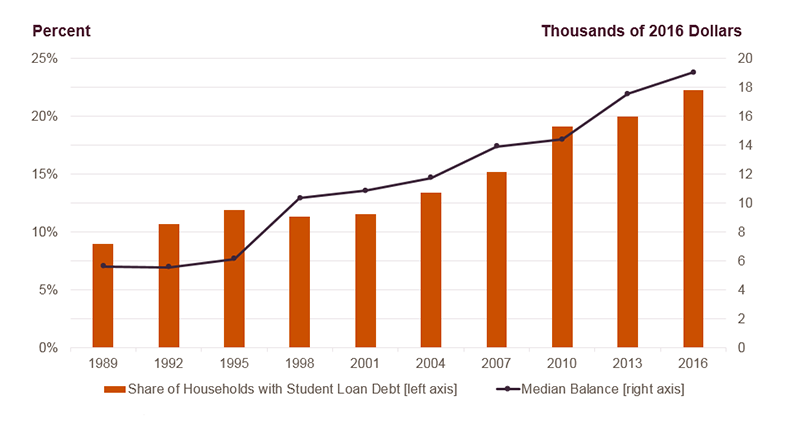

My brief, which uses data from the Survey of Consumer Finances (SCF) and provides an update to a 2015 brief that analyzed 2013 SCF data, finds that nearly one in four US households were carrying student loan debt in 2016. The growth in the incidence of debt is striking: 9 percent of households were carrying student loan debt in 1989 (the first year of SCF student loan data), a percentage that doubled by 2010 and continued to grow. The median household student loan debt balance, measured in constant 2016 dollars, grew similarly, doubling from $6,000 in 1989 to nearly $12,000 in 2004, and more than tripling by 2016 to $19,000 (Figure 1).

Figure 1: Student Loan Debt Has Increased Substantially Over the Past Two Decades

Notes: Dollar values have been adjusted for inflation using the CPI-U for All Items. Households without student loan debt are excluded from the median debt calculation.

Source: JCHS tabulations of Federal Reserve Board, Surveys of Consumer Finances.

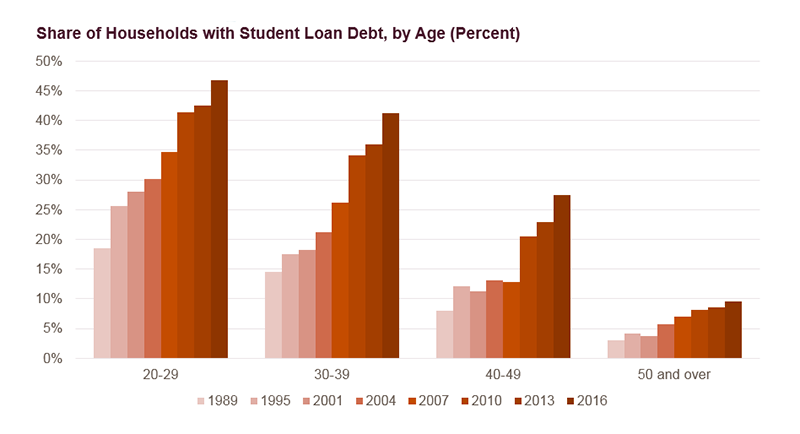

The brief also finds that while student loan debt is highest among young Americans – nearly half of households headed by 20-29 year-olds had outstanding student loans in 2016, up from less than one-fifth of those households in 1989 – the growth in this debt is in no way limited to them. In 2016, over 40 percent of households headed by someone in their 30s, 25 percent of households headed by someone in their 40s, and nearly 10 percent of households headed by someone aged 50 and over had outstanding student loans (Figure 2). The share of households with student loan debt has been rapidly growing for all of these age groups since 2007, particularly for those headed by someone in their 30s or 40s.

Figure 2: Student Loan Debt is Becoming More Common Among All Age Groups

Note: Age is for head of household. Source: JCHS tabulations of Federal Reserve Board, Surveys of Consumer Finances.

The amount of debt is also striking. Over 40 percent of borrowers had balances higher than $25,000 in 2016, and more than 20 percent owed more than $50,000 (in real 2016 dollars). Borrowers with graduate or professional degrees were more likely to have over $25,000 in student loan debt than those with bachelor’s or associate’s degrees, but these households were also more likely to have higher incomes and more wealth. Perhaps more worrying is that 20 percent of borrowers owing more than $25,000, and in repayment on their student loans, did not have a college degree in 2016.

The new brief also found that young renter households with student loan debt have less wealth and cash savings than those without student loan debt. While this is not surprising, the difference can be substantial. For example, the median net wealth for 20-39 year-old renter households with student loan debt and a bachelor’s degree in 2016 was $6,100, while the net wealth for the same group without student loan debt was $26,900. According to several studies, including a 2017 report produced by the Federal Reserve Bank of New York, these differences, along with the growing share of younger households carrying student loan debt, have contributed to the decline in homeownership rates for young households.

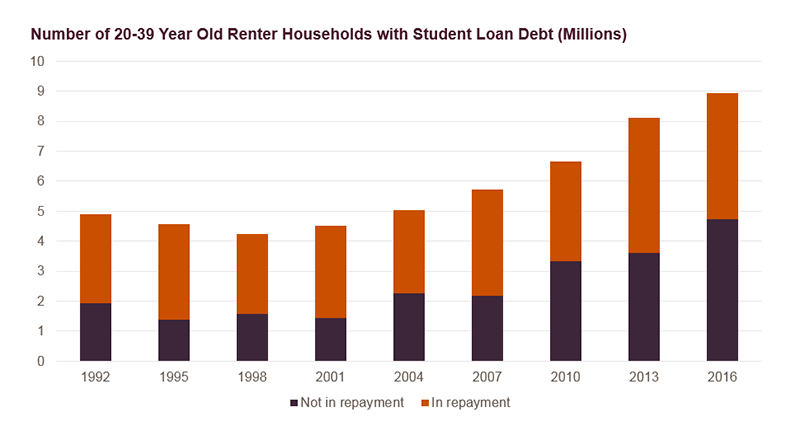

Another potentially significant trend highlighted in the brief is that for the first time since the SCF began tracking student loans in 1989, more than half of young renter households with student loan debt were not making payments on those loans in 2016. A total of 4.7 million renter households headed by 20-39 year-olds were not making payments on their student loans in 2016, compared to 4.2 million households that were making payments. This is a marked shift from 2013, when 3.6 million 20-39 year-old renter households were not making payments, while 4.5 million of these households were making payments (Figure 3). This may be because of deferment due to enrollment in graduate education, an increasingly common path, or it may be due to a growth in deferments because of special circumstances, including financial hardship.

Figure 3: Over Half of Young Renters with Student Loans Are Not in Repayment

Notes: Data shown are for 20-39 year old renter households, excluding households without student loans. Age is for head of household.

Source: JCHS tabulations of Federal Reserve Board, Surveys of Consumer Finances.

While the brief does not delve into the causes of this substantial growth in student loans, research in the 2019 Poverty and Inequality Report pointed to growing tuitions, increased attendance at high-cost yet low-return for-profit schools, and the lingering effects of the Great Recession on incomes and employment. My brief provides details on the resulting consequences: growing numbers of households with debt, increasing levels of debt, and the increasing tendency to postpone repayment of this mounting debt.