Rental Market Likely Headed for a Slowdown

While it is too early to know how COVID-19 will affect rental markets, early signs suggest another slowdown in demand is coming. Already, leasing activity is down at a time when new apartment completions are nearing a 30-year high. Cooling demand could soften rents at the high end of the market, but those benefits are unlikely to translate to lower rents at the bottom end as households compete for an already limited low-rent supply.

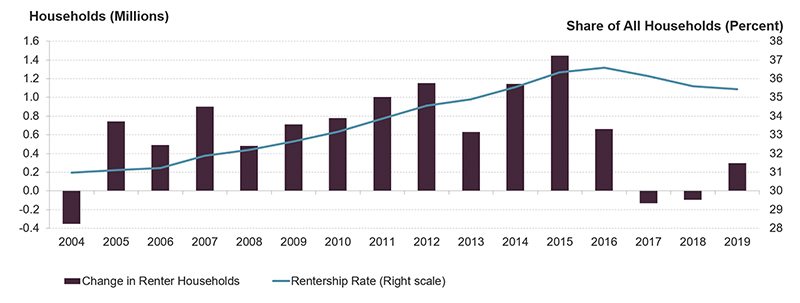

To begin with, a COVID-19 recession is likely to cool already slowing demand. Renter household growth boomed from 2004 to 2016, posting average annual increases of 846,000 households. After 12 years of robust growth, rental demand receded in 2017 and 2018 with net losses of renter households (Figure 1). While demand did pick up again in 2019, the gain of less than 400,000 households was well below the increase in any year from 2004–2016.

Figure 1: Pandemic Will Likely Cool Already Slowing Rental Demand

Source: JCHS tabulations of US Census Bureau, Housing Vacancy Surveys.

With unemployment claims at record highs, reduced incomes could suppress the household formations that have driven new rental demand in recent years. Lower household incomes due to lost wages could also lead to decreased demand as existing households double up with others. Some of this may be offset by households who otherwise would have become homeowners remaining renters longer.

Slowing demand would be drastically different from the last recession, which provided a major tailwind for rental markets. A COVID-19 recession most likely will not have the same mass displacement of homeowners or tightening of mortgage credit that fueled rental demand over the last decade. The immediate housing policy responses to COVID-19 have had an emphasis on keeping homeowners in their homes through a moratorium on foreclosures and mortgage payment forbearance. If the economic recovery takes longer and the ongoing policy response is inadequate, however, foreclosures could become more common, credit could tighten as lenders and servicers absorb the losses from foreclosures and forbearances, and homeownership could become less attainable for many households. All of this would potentially push more households toward renting. Even so, it currently looks unlikely that transitions from homeownership to renting would match the scale of the previous recession.

Cooling demand is already evident in decreased leasing activity. The spring season is usually a busy time for apartment leasing, but apartment searches are down this year. With recommendations or mandates that people stay home, searching for new apartments is difficult. Even online searches are down from their normal pace with the apartment listing website RENTCafé reporting a 22 percent decrease in traffic in mid-March as compared to a year earlier. Economic uncertainty and social distancing directives may also make people wary of making a move now. No matter the cause, depressed leasing activity will contribute to already low mobility rates and will make it more difficult for property owners to fill current vacancies.

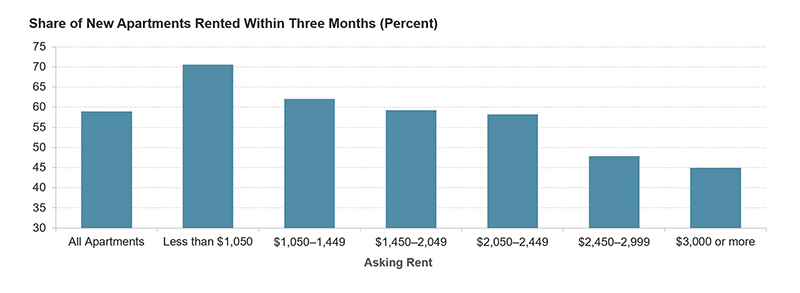

Class A properties, which tend to be newer and higher-quality apartments, will likely take the biggest hit from slowing demand. Robust growth in high-income renters has supported demand for high-end units over the last decade. Since 2010, households with incomes over $75,000 made up about three-quarters of the growth in rental demand. But with household incomes likely to take a hit, the growth of higher-income renters is likely to slow and absorption rates for new apartments could fall. RealPage notes that owners of high-end properties are likely to offer rent discounting or concessions in an effort to attract and retain tenants. Even with discounts and concessions, it may be more difficult to fill the nearly 30-year high numbers of new apartments hitting the market. New units with high asking rents, which tend to have lower absorption rates to begin with, might have especially low occupancy rates (Figure 2). Trends in the Class A segment of course depend on what happens with new construction and whether the economic uncertainty and possibility of reduced demand causes builders or lenders to pull back.

Figure 2: Higher-End Apartments that Tend to Have Lower Absorption Rates May Become Harder to Fill

Notes: Absorption rates are for newly completed (July–September 2019), nonsubsidized apartments in buildings with at least five units.

Source: JCHS tabulations of US Census Bureau, Survey of Market Absorption.

With softening at the high end of the market, overall rent growth may finally slow. The long economic expansion and steadily increasing rental demand resulted in a nearly record-breaking 30 consecutive quarters of real rent growth as of the first quarter of 2020. In the last 22 quarters, rents have grown by more than 3 percent each quarter. Stifled new demand and high numbers of newly completed units could increase vacancies while the reduced incomes of current renters will challenge their ability to pay at current levels. Property owners may need to lower rents, at least temporarily, or risk having unfilled apartments.

The benefit of softening rents is not likely to reach lower-income renters who face the greatest affordability challenges. RealPage does not anticipate much movement in Class B or Class C properties where starting vacancy rates are tight. Additionally, Apartment List expects that further decreases in mobility rates arising from the pandemic will make affordable options even more scarce. Currently, a big unknown is the role that anti-eviction policies will play for both lower-income households and rental markets. These policies extend for 30 days or more and prevent landlords from evicting tenants but do not forgive rent payments. Renters already living on the margin may have reduced incomes and will have an even harder time paying rent. It remains to be seen if there will be a wave of evictions when the moratoria expire and how many households will be unable to pay the rent in the meantime. Potential months of unpaid rent will surely create ripple effects for small landlords and local governments while evictions would disrupt the lives of renter households. Additional interventions may be needed to ensure the stability of lower-rent apartments and lower-income households.

The impact of COVID-19 on rental markets will depend on how long the pandemic lasts, how quick the recovery is, and how robust the policy response is. In the near term, the pandemic will likely widen inequities by reducing rents at the top of the market for higher-income renters and further constraining affordable and available options for lower-income renters.