Move Over Millennials, Gen Z is Driving Rental Demand

As slowing multifamily construction underscores a downturn in rental markets, optimists see rental demand holding strong over the long run, and point to favorable demographics as a reason to remain optimistic. But are demographics truly favorable for rental housing?

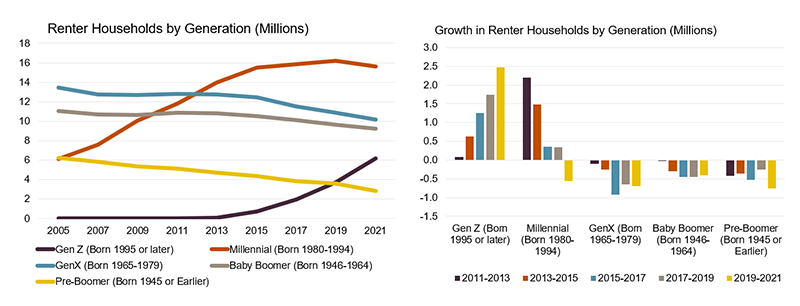

At first, the story seems negative. For one, after decades of driving growth, the number of renter households headed by millennials (aged 28-42 in 2022) has peaked and is declining (Figure 1). Indeed, this large cohort has reached ages when more households are transitioning into homeownership rather than forming new renter households. Gen Z (aged 13-27 in 2022) is now the only generation adding renter households, therefore demand for rental housing will continue to grow only if the number of new Gen Z renter households added outnumbers losses among older generations, who are leaving rental units due to homeownership transitions or mortality.

Figure 1: The Number of Millennial Renters Has Peaked, Now Gen Z is Driving Renter Household Growth

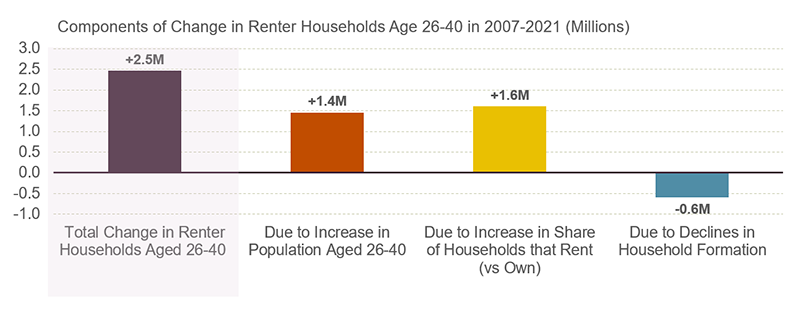

In many ways, this is the end of an era. In the 2000s and 2010s, millennials in their late 20s and 30s ushered in a surge in the number of renter households, not only because the cohort is larger than previous generations but because millennials rented at higher rates than earlier generations at the same age (Figure 2). But can we expect Gen Z to continue either of these trends to uphold the levels of growth in renter households seen over the past 15 years?

Figure 2: Millennials Added on 2.5 Million Young Renter Households by Being Larger and Renting at Higher Rates than Gen X

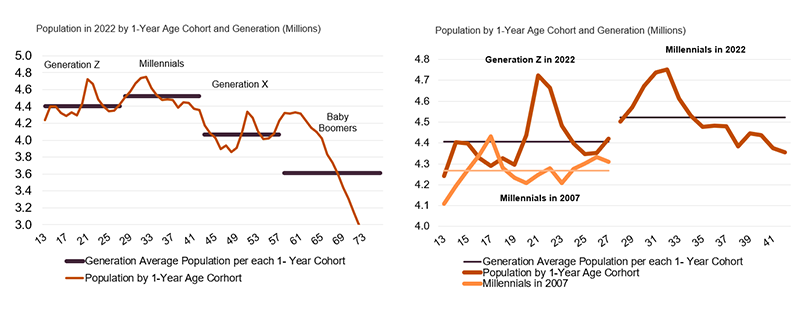

A major factor determining whether Gen Z forms as many renter households as millennials did before them is how many people are in this generation relative to millennials. According to US population estimates in 2022, there are 66.1 million people in the 15-year cohort aged 13-27 who make up Gen Z, compared to 67.8 million people aged 28-42 who make up the millennial generation. Based on this, Gen Z is currently not as large a generation as millennials, but close enough to maintain similar levels of rental households (Figure 3, left).

Figure 3: The Current Population of Gen Z is Not as Large as Millennials Today, But Gen Z Is Larger Than Millennials Were 15 Years Ago at Similar Ages

However, if we dig deeper, we find that Gen Z today is 2.1 million larger than millennials were at similar ages 15 years ago (Figure 3, right). Adding up the overall population of our 15-year generational cohorts, we find a total of 66.1 million Gen Z people aged 13-27 in 2022, compared to 64.0 million millennials aged 13-27 in 2007.

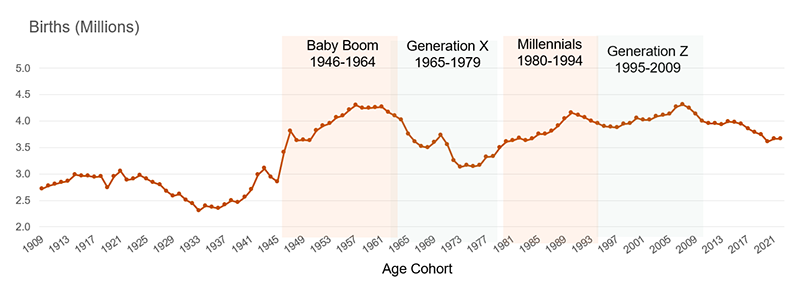

This may be surprising, but it is supported by historical US birth records, which show the highest levels in Gen Z birth years (1995-2009) and a historical peak in births in the late 2000s, which is Gen Z people who are in their early 20s today (Figure 4).

Figure 4: US Births Peaked in 2000s with the Gen Z Population

Indeed, the number of millennials in the US grew by nearly 4 million over the past 15 years as a result of gains from immigration. The boost was so large because it was the years millennials passed through their 20s and 30s, ages where immigration rates peak.

This could be occurring now for Gen Z, the oldest of whom are in their 20s. But can we expect the population of Gen Z to increase as much from immigration over the next 15 years as the millennial population did over the last 15 years? On one hand, it is entirely possible because the last 15 years include years when immigration rates hit historic lows. On the other hand, immigration rates are highly unpredictable and the future of immigration policy is particularly challenging right now and subject to contentious debate.

The number of renter households Gen Z adds in the next 15 years will be an important pillar of rental housing demand, and the extent to which the size of the Gen Z population grows in the next 15 years ultimately could determine whether the number of renter households in the US grows, stabilizes, or declines in the coming years. That this growth is so highly dependent on immigration levels over the coming years directly connects the future of rental housing demand to immigration policy and represents just one of the many links between housing and immigration.

But population growth among Gen Z is just one factor that will determine future rental demand along with the rates of household formation and homeownership among this generation, and the speed at which millennials and older generations transition to homeownership or otherwise exit rental markets. Stay tuned for more on the balance of each of these trends, and what they mean for rental demand going forward.