Harnessing the IIJA’s Weatherization Assistance Program to Leave No Household in the Cold

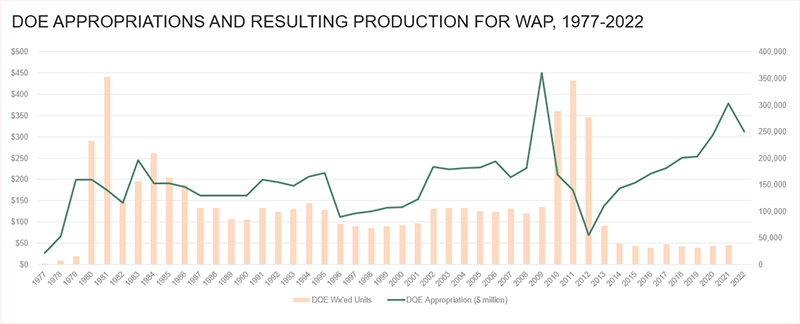

The Infrastructure Investment and Jobs Act (IIJA) of November 2021 included a $3.5 billion one-time infusion into the federal Weatherization Assistance Program (WAP). With IIJA, the national investment in the long-term energy efficiency of housing units occupied by low-income households modestly approaches appropriations for the companion Low-Income Home Energy Assistance Program, the safety net for paying low-income households’ energy bills during emergencies. The only other time the federal government invested at this magnitude was through the 2009 American Recovery and Reinvestment Act (ARRA) and its $5 billion appropriation (Figure 1).

Figure 1. WAP Funding and Production Varies, Swinging During ARRA (2009-12) and Now with IIJA (Starting 2023)

With no other major appropriations for affordable housing from the past year’s historic legislation, the IIJA’s WAP supplement needs to be harnessed to support all eligible households. The Center launched a review of the ARRA’s effectiveness and recent program guidance to identify mechanisms to support rental multifamily weatherization with the IIJA. We reviewed pre-ARRA and ARRA documentation from DOE sources and conducted interviews with current WAP stakeholders in federal and state governments as well as WAP advocacy organizations.

The study was supported by the Housing Crisis Research Collaborative. In “Targeting Weatherization: Supporting Low-Income Renters in Multifamily Properties through the Infrastructure Investment and Jobs Act’s Funding of the Weatherization Assistance Program and Beyond,” a new working paper I co-authored with Michael Bueno, Michael Johnson, Francisco Montes, and Riordan Frost, we found several opportunities.

The Need and the Challenges

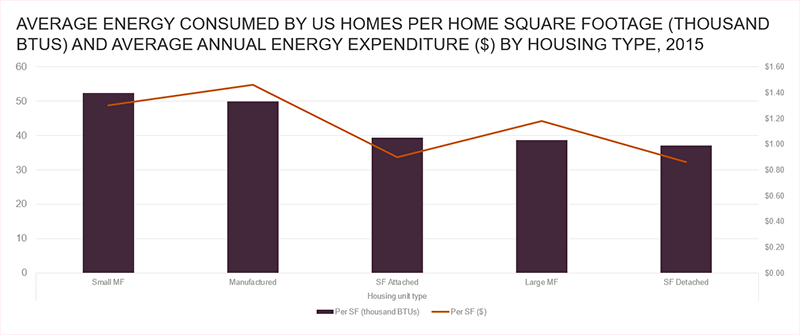

Low-income renters, especially those living in small multifamily properties (2-4 units) continue to be underserved by energy programs administered at all levels of government. These residents live in the most energy-intensive homes and pay more for energy used per square foot than almost all other housing types (Figure 2). These households are also more likely to experience energy insecurity.

Figure 2. Energy Intensity Is High in Small Multifamily Homes, as Are Average Energy Expenditures for Constituent Households

Yet, WAP’s historical emphasis on single-family homes overlooked the 63 percent of renters who live in multifamily properties, which is divided between those living in small multifamily buildings (17 percent) and large multifamily properties (46 percent). In some states, such as Rhode Island, up to 40 percent of renters live in small multifamily properties. Twice as many WAP-eligible households (10 percent) as WAP-ineligible households (5 percent) live in small multifamily buildings. The importance of this building type for renters—and especially for low-income ones who could receive WAP aid—is a critical parameter for serving the 38.8 million US households who qualify.

The ARRA-supported WAP attempted to increase service delivery to multifamily properties while scaling to ten times its normal delivery capacity in two years. Several implementation challenges were identified that continue to inhibit the program’s effectiveness and delivery, including the funding variability; the lack of monitoring and reporting; limitations on the allowable technological interventions; and the capacity of local service agencies that conduct the work for state WAP offices.

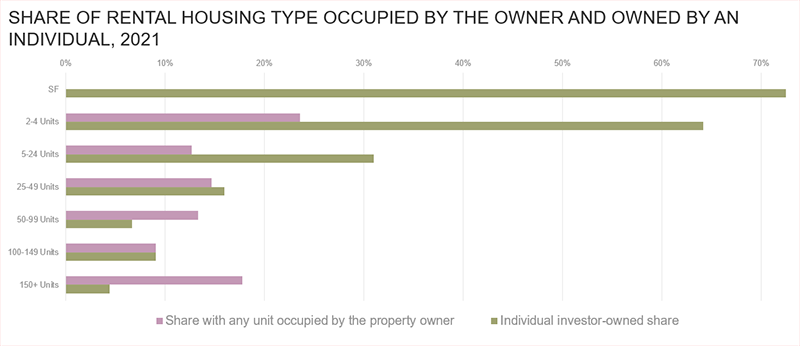

These challenges apply to all housing types, but the ability to identify and recruit property owners is acute for small multifamily properties. These properties tend to be owned by private individuals, many of whom reside in or near the property, and who often don’t have the resources to improve their buildings. They are also more challenging to identify compared to corporate owners with professional property managers. Compared to large multifamily properties, higher shares of small multifamily properties are owner-occupied and individually owned: 64 percent of small multifamily rental properties are owned by individuals, and 24 percent of these properties have units that the owners occupy (Figure 3).

Figure 3. More Likely for Small Multifamily Homes to Be Owned by an Individual, and for Owner to Occupy Building

Recommendations

Given these insights, there are several opportunities for improvement to the WAP governance structure:

- National Program. DOE could continue partnerships with other federal agencies such as the US Department of Housing and Urban Development (HUD) to identify small multifamily properties and provide guidance on state and local rental registries and property databases that could be integrated into TA content. This technical content could also highlight the methods of state and local offices that successfully serve this stock.

- State Offices. State weatherization offices could perform housing and demographic analysis, coordinated with peer state agencies, to identify small multifamily properties in their jurisdictions. Incorporating these data into plans to serve this population, and apportioning budget and resources, could ensure that DOE’s intentions are translated on the ground.

- Local Implementers. Most local implementers have limited capacity for identifying properties, recruiting, and coordinating property owners and tenants, and implementing the technological fixes needed for this housing type. State offices, in partnership with local public- and civil-sector housing or energy groups and private workforce trainers, could deliver knowledge and funds to fill these gaps.

The latest $3.5 billion infusion of funds into this important social safety net and national decarbonization program from IIJA, and its removal of prevailing wage requirements for buildings with fewer than five units, could provide an opportunity to rectify the oversight of this important segment of the US rental housing stock.

Furthermore, the 2022 Inflation Reduction Act (IRA) supports tax credits, rebates, and related programs that could spread the benefits of energy efficiency to low- and moderate-income households and property owners. If conducted thoughtfully, WAP’s small multifamily rental service delivery and relaxed workforce rules could be a model for all energy programs and provide the desperately needed services to these households while helping meet the nation’s climate goals.