Concentration in Homebuilding Driven by a Few Large Builders

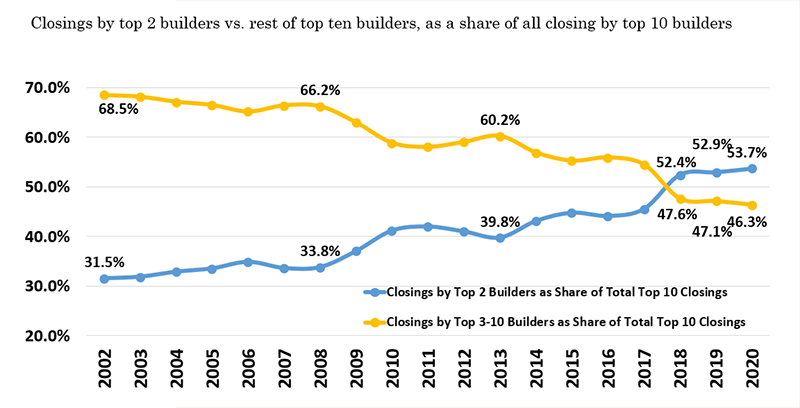

The 100 largest home builders in the US now account for about half of all new single-family home sales, up from just over a third two decades ago. However, according to “Concentration in the Homebuilding Industry: Trends, Strategies, and Prospects,” our new Center working paper, most of these gains reflect the growing market share of just two homebuilding companies – D.R. Horton and Lennar. Indeed, these two companies were responsible for almost two-thirds of the gain in market share among the top 100 builders from 2002 to 2020. As a result of this growth, these two firms now build more homes than the combined total of the nation’s third to tenth largest home builders (see Figure 1).

Figure 1: The Top 2 National Builders Now Produce the Majority of Homes Built by All Top 10 Builders

Source: Authors’ analysis of Builder Magazine BUILDER 100 surveys.

These changes are notable because the homebuilding industry has traditionally been one of the most fragmented industries in the US economy, with most companies building only a small number of homes per year. Among the reasons for this fragmentation is the local nature of residential construction.

Home builders must respond to local demand and supply conditions, and also navigate a complex web of local zoning ordinances, land-use regulations, and building codes. At the same time, though, they must have the sophistication to address the complexities of land entitlement, coordinate an extensive set of construction workers and subcontractors, and have an adequate financial position to cover their capital-intensive operations. In addition to these requirements for success, builders must cope with the inherent cyclicality of the industry.

Homebuilding is highly sensitive to changes in interest rates, household incomes, and the outlook for the broader economy. All these factors make it especially challenging for builders to scale their operations.

The top two home builders have used two strategies to grow their market share. The first has been to concentrate their efforts in major metro areas across the country. In fact, over the 2019-2020 period fully 80 percent of all closings by D.R. Horton and Lennar were in the top 50 largest markets. By comparison, the share of single-family closings for all home builders in these markets nationwide was around 60 percent. In doing so, these builders typically dominate the markets they serve. For example, D.R. Horton ranked in the top ten in terms of volume in 41 of the largest 50 metropolitan markets in 2020. The company also ranked either #1 or #2 in more than half (23) of the markets where it was among the top ten builders. Lennar ranked in the top ten in 35 of the 50 largest markets but held a more dominant position in these markets. The company was ranked #1 or #2 in 77 percent (27 of 35) of the markets where it was ranked in the top 10.

In addition to growing their operations internally, both home builders have relied on strategic acquisitions to reach new markets and expand their overall production levels in the markets they serve. For example, the Lennar acquisition of CalAtlantic in early 2018 facilitated an increase in market share in most of the key markets Lennar served. In 2017, it held the top position in terms of number of homes closed in just two of the top 50 metro areas in the country. It was among the top two builders in a total of four metro markets that year and was in the top five in 14 markets. After the acquisition, it held the top position in 18 markets, was among the top two in 28, and in the top five in 35 of these major metro areas. It’s homebuilding revenue also increased almost 12 percent in 2018, from a combined $17.7 billion for CalAtlantic and Lennar in 2017 to $19.1 billion in 2018.

However, even with the commanding presence of these top two builders in most of the markets they serve, regional builders have shown that they can compete effectively with national builders, particularly in mid-sized metros. Many of the scale benefits of homebuilding—buying power with local suppliers, coordination of subcontractors, and even some elements of the land assembly and entitlement process—play out principally at the local level. In many instances, individual market performance is critical since potential national-scale benefits often have not been realized beyond local operations. This is because of different local regulatory requirements and difficulties in coordination across largely independent local divisions of many national builders.

Homebuilding companies that focus their operations in several (or even a few) major metros and successfully scale their operations in these areas will likely generate a disproportionate share of growth in the coming years. However, given the local market focus of the industry, homebuilding is unlikely to become as concentrated as many other major manufacturing industries like aircraft, computers, or automotive, which can supply their products for national or even international markets out of a few locations.