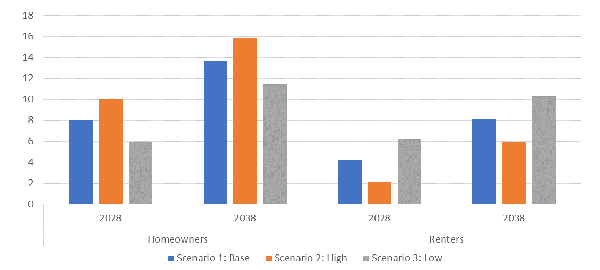

Three Scenarios for Growth in Homeowner and Renter Households

The dramatic decline in the homeownership rate—from a high of 69 percent in 2004 to a low of 63 percent in 2016—has generated substantial discussion about the future of homeownership in the United States. While the recent uptick in the homeownership rate—to above 64 percent in 2018—ended the rate’s decline, there continues to be considerable uncertainty about its future trajectory. For example, if the macroeconomy continues to support full employment and wages continue to grow, then it is likely the homeownership rate will continue to rise. Conversely, if the economy weakens or enters a recession, then the homeownership rate might well again start to fall.

In a new working paper, I present tenure projections that describe three potential scenarios for growth in the number of homeowner and renter households from 2018-2038. All three scenarios use recently updated projections on household formation detailed in a 2018 working paper by my colleague Daniel McCue. That paper projects a net increase of 12.2 million households between 2018 and 2028 and an increase of 21.7 million households by 2038. These estimates are 10-13 percent lower than the projections previously produced by the Center for 2015-2035. The decline is primarily due to reductions in the Census Bureau’s projections for immigration, with a smaller contribution from the three-year shift in the projection period (from 2015-2035 to 2018-2038).

Figure 1. Projected Growth in Homeowner and Renter Households from 2018 (millions)

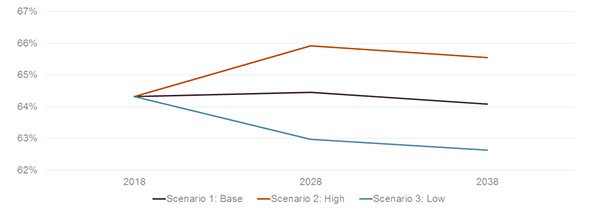

The paper’s “base-case scenario,” which applies constant 2018 homeownership rates by age, race/ethnicity, and family type to the new projected household counts, implies that almost two-thirds of the total growth in households would be among homeowners (Figure 1). Specifically, there would be an increase of 8.0 million homeowner households and 4.2 million renter households by 2028, and 13.6 million homeowner households and 8.1 million renter households by 2038. Moreover, the projected changes in the demographic composition of U.S. households by age, race/ethnicity, and family type will largely have offsetting impacts on the homeownership rate, which would rise from 64.3 percent in 2018 to 64.5 percent in 2028 and then decline slightly to 64.1 percent by 2038 (Figure 2).

Figure 2. Projected Homeownership Rates by Scenario and Year

The paper’s “high” and “low” scenarios describe the implications of alternative trajectories in the homeownership rate. Under the “high” scenario, which projects what would occur if homeownership rates rebounded to their longer-term averages, almost three-quarters of the projected growth in households would be among homeowners. There would be an additional 10.1 million homeowner households and 2.1 million renter households by 2028, and an increase of 15.8 million homeowner households and 5.9 million renter households by 2038. Moreover, the homeownership rate would increase from 64.3 percent in 2018 to 65.9 percent in 2028 before falling slightly to 65.6 percent in 2038.

Conversely, the “low” scenario describes what would occur if homeownership rates stopped rising and instead fell by an amount proportional to the increase in the high scenario. If this occurred, the projected homeownership rate would fall from 64.3 percent in 2018 to 63.0 percent in 2028 and 62.6 percent in 2038. These homeownership rate decreases would result in almost even levels of growth in homeowner and renter households. Specifically, in the low scenario, the nation would add 6.0 million homeowner households and 6.2 million renter households by 2028, and 11.5 million homeowner households and 10.3 million renter households by 2038.

None of these scenarios are likely to precisely capture the complex interplay of factors that will determine the homeownership rate in future years. Instead, each scenario provides a reference point for understanding the implications of alternative homeownership rate trajectories for future growth in households. Additionally, because it is possible that future homeownership rates might extend outside the range defined by the high and low scenarios, the differences between projection scenarios also offer useful information about how alternative homeownership-rate trajectories might affect the number and distribution of homeowner and renter households by age, race/ethnicity, and family type.

In the near term, the homeownership rate’s actual trajectory will likely depend on the occurrence and timing of broader changes in the macroeconomy. Over the longer-term, the trajectory of the homeownership rate will be influenced by a larger set of factors related to households’ demand for housing as a place to live, their demand for the investment attributes of homeownership, any constraints on their ability to access mortgage credit, and the number of homes that are for sale. In the coming years, the Center plans to continue updating its projections as the Census Bureau releases updated population projections.