Supporting Immigrants Can Expand Black Homeownership Opportunities

Efforts to close the historically large Black-white homeownership gap should take account of the fact that many Black households are headed by immigrants, particularly in the Northeast, Texas, and Florida. In “Black Immigrant Homeownership: National Trends and the Case of Metro Boston,” a new working paper we co-authored with Raheem Hanifa, we use American Community Survey data to highlight the growing number of Black immigrant households generally and Black immigrant homeowners specifically. In the paper, we also explore how these trends are playing out in greater Boston.

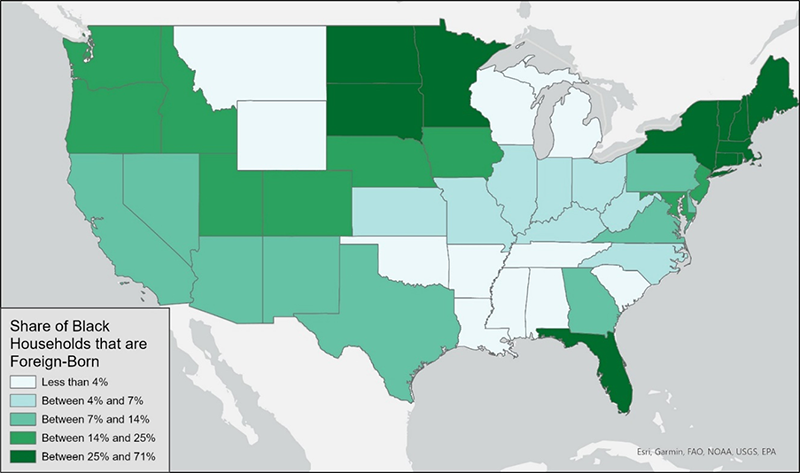

Looking first at Black immigration and homeownership across the nation, the paper shows how, in many states, immigrants make up high shares of all Black households (Figure 1). Nationwide, one in eight Black households (12 percent, or 2 million households) are headed by someone who was born abroad. In Massachusetts, fully 46 percent of all Black households are headed by someone born in another country. Immigrants also make up high shares of Black households in other large states such as Florida (28 percent) and New York (36 percent).

Figure 1: Immigrants Make up High Shares of Black Households in Some States

Many of these Black immigrant households have become homeowners. The national homeownership rate of Black immigrants (42.1 percent) is similar to the rate of native-born Black households (41.7 percent) but both rates represent a significant gap of around 30 percent below the white homeownership rate. At the same time, homeownership rates differ widely between Black immigrant groups. Less than 10 percent of Black households headed by a person born in Somalia own homes, compared to 56 percent of those headed by a person born in Jamaica. We highlight the unequal extents to which different Black immigrant groups attain homeownership and identify possible explanations behind these differences, considering the impact of geographic location, as well as the role of country of origin, age structures, and immigration histories.

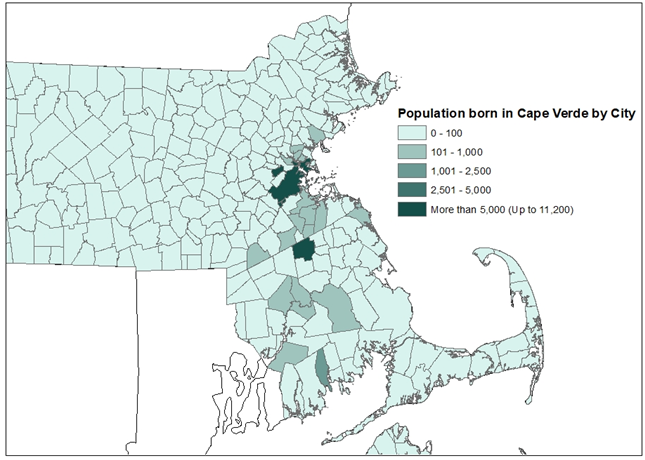

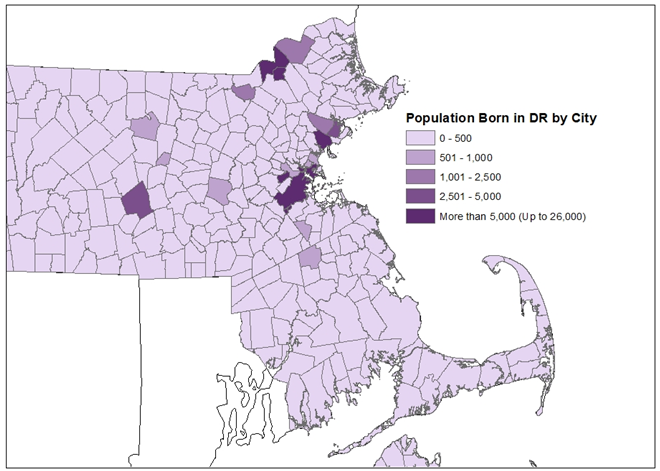

The paper then zooms in on Black immigrant homeownership in Massachusetts as a case study of a state where many Black households have immigrated. Here we compare mobility trends at the municipal level both within and outside of the city of Boston, to show how the suburbs are playing an increasingly important role for Black immigrant homeownership opportunities. Our findings also show how immigrant groups are geographically concentrated in a small number of communities throughout eastern Massachusetts (Figure 2), with some suburban cities having specialized as “ethnoburbs” that house specific immigrant groups.

Figure 2: Immigrants from Cape Verde Live in a Small Number of Municipalities South of Boston...

…Whereas Immigrants from the Dominican Republic are More Likely to Live in a Few Places to the North and West of Boston

The paper argues that State and federal Black homeownership policies can benefit from incorporating the specific challenges and opportunities of Black immigrant homebuyers. At the same time, we acknowledge the continued importance of supporting homeownership among native-born Black households to redress generations of historical exclusion and discrimination. We offer specific recommendations, including financial literacy programs targeted at immigrants, community-based efforts to overcome language and trust barriers, and expanded efforts to integrate multi-family and multigenerational housing models in homeownership programs and policies.