Small Consumer Segment Drives Majority of Remodeling

Of the more than 77 million homeowners in the US, an estimated 22 million completed at least one home improvement project in 2017, according to our latest Improving America’s Housing report. Yet over half of the $233 billion spent on home improvements was driven by just 3 percent of owners who reported remodeling expenditures of $25,000 or more. The report’s data tables also reveal that both the average level of remodeling expenditure and the likelihood of reporting any home improvement vary by key demographic and socioeconomic measures—including household income, family type, and age.

Not surprisingly, for example, households with incomes of $120,000 and over were most likely to report spending on home improvements. Their average annual expenditures were also highest at $5,400 compared to $3,000 across all homeowners. As a result, while these owners made up only a fourth of all US homeowners, they drove 45 percent of total home improvement market spending.

Married couples with children were most likely to pursue projects (and spent the most on average), while single persons were the least likely. Millennials (born after 1984) were also more likely than other generations to undertake projects, although they spent nearly 15 percent less on average. Partly due to affordability challenges and low inventories of homes for sale, millennials comprised a small share of homeowners in 2017, and so they drove only 6 percent of improvement market spending.

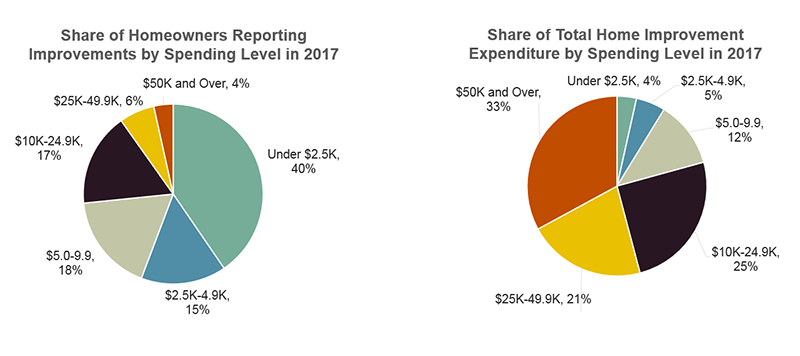

Figure 1: Small Segment Drives Over Half of Remodeling Outlays

Source: Improving America’s Housing 2019, Appendix Data Tables, Table A-7.

In contrast, baby boomers (born 1945–64), who spent 11 percent more than other owners on average, and who owned and occupied nearly 34 million homes in 2017, drove nearly half (46 percent) of homeowner improvement spending that year.

Among owners who made home improvements, most undertook relatively minor projects. As detailed in the report, fully 40 percent of the 22 million households with home improvement projects reported spending less than $2,500, and 56 percent spent less than $5,000. Indeed, spending of $25,000 or more—which would indicate upper-end discretionary projects or large-scale exterior replacement projects or systems upgrades—was undertaken by only 10 percent of owners who tackled remodeling jobs in 2017 (3 percent of all homeowners). Yet these high-spending households drove over half (54 percent) of the homeowner improvement market in 2017.

Understanding which household demographic segments are most likely to pursue remodeling projects can be invaluable for remodeling companies, as they seek to identify customer leads. Further information about the size of the remodeling market and spending patterns by these and other key demographic and socioeconomic groups are available in the report’s detailed data tables.