Rental Markets Are Cooling, but Rents Still Far Exceed Pre-Pandemic Levels

Rent growth has moderated recently from historically high pandemic-era levels, according to our newest report, The State of the Nation’s Housing 2024, as overheated markets cooled and new construction drove up vacancies. At the most recent reading in the second quarter of 2024, national rents increased annually for the third consecutive quarter by a modest 0.2 percent, a sharp turnaround from the 15.3 percent recorded in early 2022 (Figure 1). Despite this cooling, rents have increased significantly since before the pandemic, landing fully 20.9 percent above those from five years ago.

Figure 1: Rents Remain Elevated Despite Recent Moderation

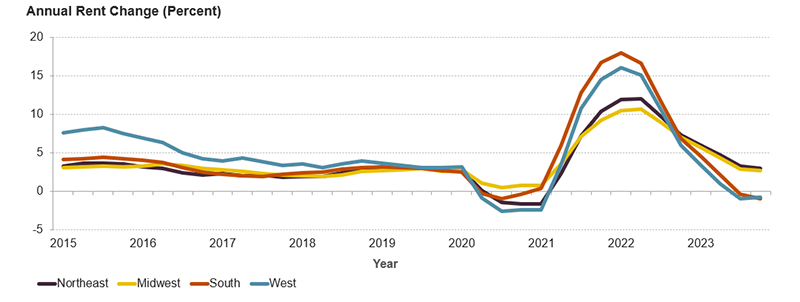

This national trend has played out differently across the country, due to differences in demand and supply factors. For example, rents have continued to grow most in the Northeast and Midwest by 2.4 and 2.7 percent respectively, down from 12.0 and 10.6 percent in 2022 (Figure 2). Markets in the West have also softened significantly in recent months, with rents remaining unchanged on average on an annual basis (down from 15.1 percent growth two years prior). And while rent growth has moderated in much of the country, rents have outright declined in some places. In the South, rents declined annually by 1.4 percent in the second quarter of 2024, a significant change from the 16.6 percent growth recorded two years before.

Figure 2: Rent Growth has Slowed Markedly in South and West

Note: Rent growth is for same-store asking rents. Data cover professionally managed apartments in buildings with five or more units.

Source: JCHS tabulations of RealPage data.

Following this regional trend, rents increased most significantly in Midwest and Northeast markets, with Kansas City, Milwaukee, Cleveland, Cincinnati, and Columbus recording increases between 2.7 and 3.4 percent. In the Northeast, rents increased at comparable rates, growing the most in Newark (2.6 percent), Pittsburgh (2.3 percent), and Boston (2.2 percent). Meanwhile, rents continued to grow as rapidly in only a handful of Southern and Western markets. Rents rose by 2 percent or more in Washington D.C. (3.2 percent), Greensboro (2.6 percent), Virginia Beach (2.6 percent), and Anaheim 2.0 percent).

On the other hand, rents declined only in Southern and Western markets. Rents were down year-over-year in 15 of 21 Southern markets and eight of 14 Western markets, led by Austin (down 7.4 percent), Jacksonville (5.2 percent), and Atlanta (4.6 percent). These markets have experienced continual cooling following exorbitant annual rent growth during the pandemic in part due to robust new supply. In the West, rents decreased most in Phoenix (down 3.4 percent), Salt Lake City (2.8 percent), and Oakland (1.1 percent).

Despite recent moderation, pandemic-era rent increases mean rents are now well above pre-pandemic levels, especially in the South. Even with recent declines, rents have increased most in the Southern region by 22.9 percent. But with continued rent growth over the past year, the Midwest and Northeast are catching up, with rents rising 22.1 percent and 21.4 percent respectively since 2019. In the West, rents have increased by 18.5 percent since before the pandemic.

Rents have exploded most in the Sunbelt in recent years, often despite declines. In West Palm Beach, for example, rents have increased by 38.6 percent compared to other large markets, since 2019, yet at the most recent reading posted annual declines. Other previously hot markets with the highest rent growth since before the pandemic include Fort Lauderdale (35.7 percent), Greensboro (34.9 percent), Tampa (34.4 percent), and Riverside (33.0 percent) (Figure 3). In some markets, recent rent declines have brought longer-term rent growth close to national averages. In Austin, for instance, the nation-leading annual rent decreases mean that rents have increased just 16.2 percent since 2019.

Figure 3: Rents Are Far Above Pre-Pandemic Levels, Especially in Sunbelt Markets

Notes: Data are from the second quarter of each year shown and are indexed to 2019. Rent change is for same-store asking rents. Asking rents are for professionally managed apartments in buildings with five or more units in the 50 markets that RealPage tracks with consistent data through 2019

Source: JCHS tabulations of RealPage data.

On the other hand, rents increased by less than ten percent in Minneapolis (9.3 percent), San Jose (4.7 percent), and Oakland (3.8 percent) and rents declined since before the pandemic in San Francisco (down 6.1 percent). Rental demand in the Bay Area was hit particularly hard by pandemic-era outmigration, while robust new supply in Minneapolis has helped keep rent growth in check.

Even with recent cooling, historically high pandemic-era rent hikes have created dire affordability issues for some renters as incomes have failed to keep pace. Rents remain far above pre-pandemic levels across markets, and the relief from new construction that contained rent growth is likely to be short-lived due to recent declines in multifamily starts. In the future, these affordability issues will need to be addressed through increased rental subsidies, preserving the existing rental stock, and subsidizing construction targeted toward moderate- and lower-income households.