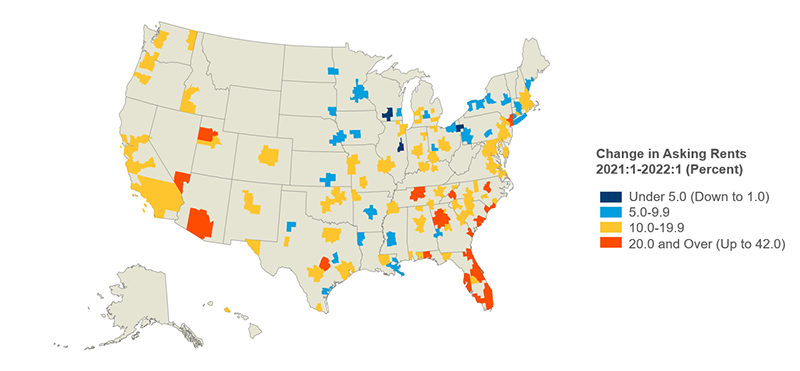

Record-Breaking Rent Growth in Markets in the South and West

Rents in more than three-quarters of the nation’s 150 large markets increased rapidly in early 2022, growing by 10 percent or more year-over-year according to our latest State of The Nation’s Housing report. Rents grew the fastest in markets in the South and West, and also rebounded in many large, high-cost markets where they had fallen early in the pandemic.

By all measures, rents grew at record rates at the beginning of this year. Rents for professionally managed apartments increased by 11.6 percent year-over-year in the fourth quarter of 2021 and maintained that pace in the first quarter of 2022, according to data from CoStar Advisory Services. CoreLogic data show that rents for single-family homes increased 12.4 percent year-over-year in the first quarter of 2022, the fastest recorded pace going back to 2004. The Consumer Price Index for rent of primary residence, which covers the entire rental stock and is slow to register changes, was up 4.8 percent year-over-year in April 2022 – its largest increase since 1987.

Contributing to this national trend, asking rents grew substantially in 150 of the nation’s largest metro markets (Figure 1). In the first quarter of 2022, asking rents for units in professionally managed apartment properties with five or more units increased by 10 percent or more year-over-year in 116 out of 150 large metro markets. Within those markets, 25 posted rent increases of 20 percent or more.

Figure 1: Rents in Most Major Markets Were Up by Double Digits in Early 2022

Note: Asking rents are for professionally managed apartments in buildings with five or more units in the 150 markets that RealPage tracks.

Source: JCHS tabulations of RealPage data.

The markets where asking rents grew the fastest were concentrated in the West and South. Eight of the ten markets with the highest rent growth were located in Florida alone, led by Naples where rents rose an astounding 42 percent year-over-year. This was followed by Sarasota (37 percent), Cape Coral (32 percent), and West Palm Beach (30 percent). Other large sunbelt markets also had some of the largest increases in asking rents, including Phoenix (26 percent), Las Vegas (24 percent), Austin (24 percent), Raleigh (22 percent), and Tucson (22 percent).

Rents also grew substantially in large, high-cost coastal markets where rental demand had fallen early in the pandemic. In New York, rents rose 20 percent year-over-year in the first quarter of 2022 – a dramatic turnaround from the first quarter of 2021, when rents fell 15 percent year-over-year. And in San Francisco, Boston, Los Angeles, Washington, and Seattle, where rents fell at least 5 percent year-over-year in early 2021, rents were up 10 percent or more in early 2022.

Rents increased more slowly in markets in the Midwest and Northeast. Nationally, rents rose by less than 10 percent year over year in just under a quarter of markets. But more than half (52 percent) of markets in the Midwest and Northeast had rent growth under 10 percent. Rents grew only slightly in less expensive markets in the Midwest, including Champaign-Urbana (1 percent), Youngstown (2 percent), and Madison, Fargo, and Minneapolis (all 5 near percent). By comparison, rents rose by less than 10 percent in just 12 percent of Southern markets and in no Western markets.

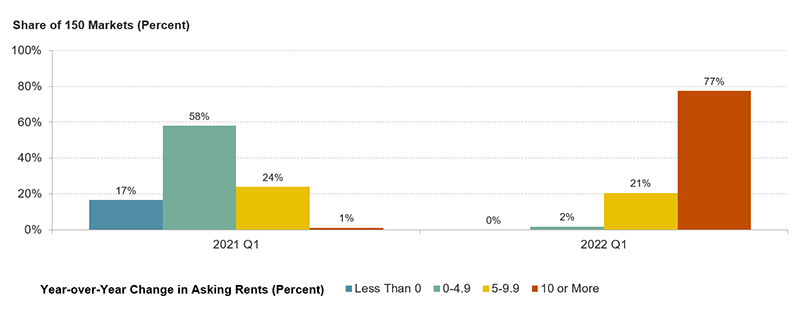

Rapid rent increases in markets across the country represent a significant change from the prior year (Figure 2). In the first quarter of 2021, rents fell year-over-year in 17 percent of markets and the majority of markets had moderate rent growth below 5 percent. In contrast, in early 2022, rents grew in all markets, with most markets posting rapid rent growth. In the first quarter of 2022, rents rose less than 5 percent in just 2 percent of markets, with an additional 21 percent of markets posting rent growth between 5 and 10 percent. Rents increased by 10 percent or more in an astounding 77 percent of markets, far above the 1 percent of markets at the same time a year earlier.

Figure 2: Rents in Large Markets Were Growing Much Faster in Early 2022 Than They Were a Year Earlier

Note: Asking rents are for professionally managed apartments in buildings with five or more units in the 150 markets that RealPage tracks.

Source: JCHS tabulations of RealPage data.

Moderating demand in the second quarter of 2022 has helped slow rent increases, but even as conditions in the professionally managed market segment begin to ease, severe housing affordability challenges remain. As of early 2022, 15 percent of renter households were behind on rent payments, according to Center tabulations of the Household Pulse Survey. And even before the recent runup in rents, many households were already unable to afford their housing. In 2020, 46 percent of renter households spent more than 30 percent of their incomes on housing, an increase in the cost burden rate of nearly 3 percentage points from the prior year. Among renter households with incomes below $15,000, fully 83 percent were cost burdened in 2020. Especially for households with lower incomes, the added financial pressures caused by the pandemic have made it even more difficult to pay for housing.