Pandemic Will Worsen Housing Affordability for Service, Retail, and Transportation Workers

While the full economic impact of COVID-19 is yet to be seen, early indications suggest that we are headed into a recession that will affect workers who were already facing affordability challenges. Workers who are unable to do their jobs remotely have lost crucial wages as businesses close or reduce their operations to slow the spread of the virus. According to our analysis, about 13 million households rely on at-risk jobs for all of their wages. Even before losing work, these households were more likely to be cost-burdened than those relying on income from other industries. This means the impending recession could be most detrimental for households already struggling with high housing costs.

This recession will undeniably be different from past recessions. Initial unemployment claims reached a new historical high of nearly 3.3 million for the week of March 15 to March 21. This marked an over 1,000 percent increase from the week before and eclipsed the previous high of 695,000 from 1982. The quick and early uptick in unemployment filings illustrates how different this recession is. As The New York Times reported recently, past recessions have been characterized by a slowing economy over several months with lagging unemployment over a longer period.

The Urban Institute also notes that services spending tends to increase as a share of expenditures during a typical recession, but this recession will likely be different as service industries are expected to be most heavily affected by the downturn. The closure of restaurants and bars will contribute to slow spending in these sectors while closed shops will also hit the retail industry. The mass cancellation of travel adds to the list of industries that will be affected, contributing to what will likely be characterized as a services recession. Indeed, analysis from Moody’s Analytics projects that jobs in transportation and travel and leisure and hospitality are at risk as well as jobs in oil drilling and extraction.

In thinking about what this could mean for housing, I was reminded of a statistic from our America’s Rental Housing report: more than half of renters who are fully employed in food preparation services are housing cost burdened (spending more than 30 percent of their incomes on rent and utilities). What could this recession mean for the millions of households who depend upon jobs that are at risk?

To answer this, I used the 2018 American Community Survey, focusing on households with at least one wage earner who worked at least 48 weeks in the past year in industries that are at risk of loss (“at-risk jobs”). These households rely heavily on income from these jobs and might bear the brunt of a services recession. At-risk jobs included those in services, retail, recreation, transportation and travel, and oil extraction. I compared households with at-risk earners to similarly fully-employed households with earners in other industries (“other jobs”).

Of the 83.7 million fully-employed households in the country who had wage or self-employment income, 12.8 million (15.3 percent) consisted of earners working only in at-risk jobs. The 58.9 million households with workers only in other jobs, making up 70.3 percent of all wage-earning households, were slightly more likely to have multiple earners and the per person earnings are higher at $52,000. The remaining 12.0 million wage-earning households had earners in both at-risk and other jobs. By definition, these households were more diversified in employment and were at least two-earner households, giving them higher household incomes on average.

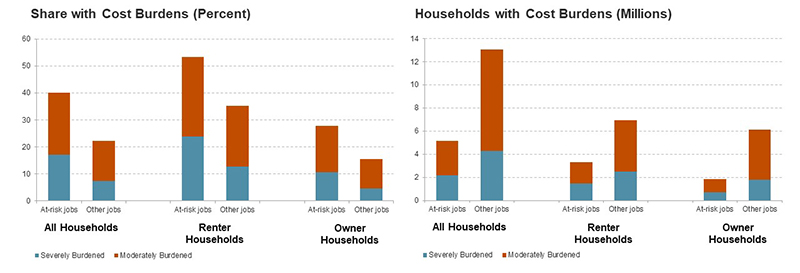

Because they tended to have lower wages (download Excel data), households depending solely on at-risk jobs for annual earnings were already more likely to be housing cost burdened. Forty percent of households (5.2 million) whose wages came exclusively from at-risk jobs were cost burdened as compared to 22 percent of households (13.1 million) whose income came only from other jobs (Figure 1). The affordability gap was even wider among renters. Renter households relying on wages from at-risk jobs had a cost burden rate of 53 percent while 35 percent of renter households in other jobs were burdened. The loss of service jobs would undoubtedly worsen affordability for households who already must spend an outsized portion of their incomes on rent each month.

Figure 1: Households Relying on Wages From At-Risk Jobs Have Higher Cost Burden Rates

Notes: All households include those with at least one wage earner who worked 48 weeks in the previous year. Households with at-risk jobs consist only of wage earners who are fully-employed in services, retail, recreation, transportation and travel, and oil extraction. Households with other jobs consist only of wage earners fully-employed in all other industries. Group quarters are excluded. Moderately (severely) cost-burdened households pay more than 30% (more than 50%) of income for housing. Households with zero or negative income are assumed to have severe burdens, while households paying no cash rent are assumed to be without burdens.

Source: JCHS tabulations of US Census Bureau, 2018 American Community Survey 1-Year Estimates.

While it is difficult to know what a COVID-19 recession will mean for housing markets, the ongoing affordability crisis will only worsen in coming months. The federal government announced a temporary moratorium on public housing evictions and foreclosures of mortgages backed by Fannie Mae, Freddie Mac, and the Federal Housing Administration. State and local governments are similarly implementing eviction protections for renters, though these delay but do not forgive rent payments. While these measures are a needed stopgap to help households with reduced incomes now, continued efforts and assistance will be necessary to ensure that those who do lose major sources of income will still be able to afford housing.