Making Rent in the Pandemic: How Are Older Adult Households Faring?

While older adults are more susceptible to COVID-19, households headed by older adults have been more insulated from the economic effects of the pandemic, according to our analysis of data from the weekly Census Household Pulse Surveys (HPS). However, impacts have not been evenly distributed across the population. Among older adults, lower-income households of color face especially difficult challenges. For instance, almost a quarter of lower-income, Black and Hispanic older adult households have little or no confidence that they will be able to make their next rent or mortgage payment.

With weekly data collection, the Household Pulse Survey provides the most up-to-date picture of the effects of COVID-19 on households. The survey uses overlapping panels of respondents sampled for three consecutive weeks. To avoid repeat respondents and to get a large enough sample for analysis by age and other household characteristics, we pooled week 3 (May 14–May 19) and week 6 (June 4–June 9). Moreover, to get a more accurate measure of the impact of COVID-19 on households rather than individuals, we used pseudo household weights described in a previous blog.

During the pandemic, older adult households have been more economically stable than younger households. This may be attributed to lower dependence on work-related income as well as greater likelihood of outright homeownership. Younger households are much more likely to report that someone in their household has lost employment income since the pandemic began, and younger households are also more likely to anticipate future income losses.

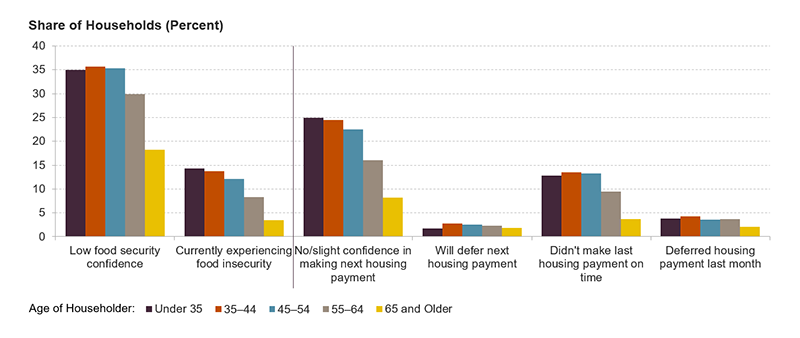

Even before the pandemic, food insecurity was the most common indicator of economic hardship, and the pandemic has affected younger households’ food security (Figure 1). More than 10 percent of younger households currently do not have enough to eat at least some of the time. For households headed by someone age 55–64, the food insecure share drops to 8 percent and to just 3 percent for households headed by someone 65 and over. Similarly, more than a third of younger households were not confident that they would have enough money to buy the food they would need over the next month, as compared to 18 percent of households age 65 and over.

Of households with mortgage or rent payments, more than a fifth under age 55 reported no or only slight confidence that they would be able to make the next payment. The share drops to 16 percent for those headed by a person aged 55–64 and to just 8 percent for adults 65 and older. Older adult households were also much less likely to have missed the previous payment (4 percent of householders age 65 and over) than households under 55 (about 13 percent).

Figure 1: Younger Households Are More Likely to Have Trouble Paying for Food and Housing

Source: JCHS tabulations of US Census Bureau, Household Pulse Survey Weeks 3 & 6.

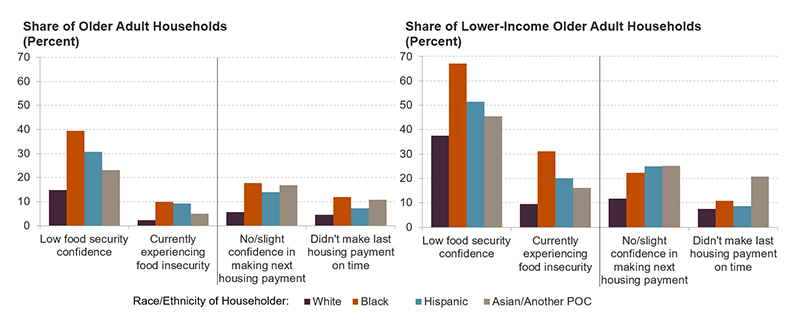

However, among older adults, the pandemic has had a disparate economic impact on households headed by a person of color and lower-income households. Eighteen percent of Black, 14 percent of Hispanic, and 17 percent of older householders who are Asian or another race or ethnicity have slight or no confidence in their ability to make their next mortgage or rent payment, compared with 6 percent of white older adults (Figure 2). Of older adult-headed households making less than $25,000, 10 percent express little confidence in their ability to make their next payment as compared with 2 percent of those making at least $50,000. A staggering 24 percent of lower-income older adult households headed by a person of color have little confidence that they can pay their rent or mortgage for the next month.

Lower-income older adult households are also less food secure. Fully 43 percent of these households express little or no confidence that they will have the food they need over the next month as compared with 8 percent of older adult households making $50,000 or more. Food security is unevenly distributed by race and ethnicity. Black older adult-headed households are 5 times more likely than households headed by white older adults to report current food insufficiency, and Hispanic older adult households are 4 times more likely. While 15 percent of white older adult households express little or no confidence in future food sufficiency, 40 percent of Black older adult households, 31 percent of Hispanic older adults and 23 percent of Asian or older adults of another race or ethnicity express low confidence in their ability to pay for food over the next four weeks.

Figure 2: Older Adult Households of Color Have Low Confidence They Will Be Able to Pay for Food and Housing

Notes: White, Black, and Asian/Another POC households are non-Hispanic. Hispanic households may be of any race. Another person of color includes anyone who identifies as multiracial. Lower-income households have reported incomes below $25,000.

Source: JCHS tabulations of US Census Bureau, Household Pulse Survey Weeks 3 & 6.

Older adults of color experience food insufficiency for a variety of reasons: affordability of food, ability and confidence to shop safely, and/or access to food distribution programs. Fourteen percent of white older adult-headed households struggle with affordability as compared to 28 percent of Black and 25 percent of Hispanic older adults. Fear of going out drives food insufficiency for Hispanic older adult-headed households and Asian households or those of another race/ethnicity, who are almost twice as likely to experience food insufficiency for this reason than white older adults. Sources of free nutrition supports also differ, with white and Hispanic older adult households turning more frequently to food pantries and Black older adults and those who are Asian or another race/ethnicity particularly relying on home-delivered meal programs.

While economic impacts have generally been less severe for older adult-headed households at this stage of the pandemic, lower-income older adults and older adults of color have been particularly vulnerable to housing and food insecurity. Additionally, these impacts broaden when considering older adults who rely on the income of a working-aged adult; these older adults may be subject to the same types of economic precarity as other younger adult headed households. Social programs to address these hardships must target resources toward the most exposed groups, especially lower-income older adults and people of color.

As local, state, and federal eviction moratoriums roll back, more older adults could also be at risk of eviction. Extending moratoriums and providing housing assistance could help stabilize these households. Already, state and local rental and mortgage assistance programs such as Massachusetts’s Emergency Rental and Mortgage Assistance program or San Antonio’s Emergency Housing Assistance program are helping to keep people in their homes. Federal supports would further protect households and property owners from economic hardships.

Finally many households cut back on food to pay other expenses and, with the end of federal supplemental unemployment benefits, pressure will increase on state and local government safety nets and nonprofit resources. Relief from older adult food insecurity has arrived through a massive investment into local Older Americans Act programs by the Coronavirus Aid, Relieve and Economic Security (CARES) Act and the Families First Coronavirus Response Act. These federal funds support programs like Meals on Wheels and do not demand state matching. While demonstrating the value of federal, state, and local partnerships, wait lists for home delivered food have nevertheless continued to increase, rising by more than 25 percent between March and April. These resources will be increasingly crucial as the pandemic continues.