Inflation Pressures Are Stressing Renter Households

More than half the nation’s renters—including two thirds of low-income renters—report that they have been very stressed by sharp increases in both rents and the price of other goods and services, according to our analysis of data from the Census Bureau’s Household Pulse Survey.

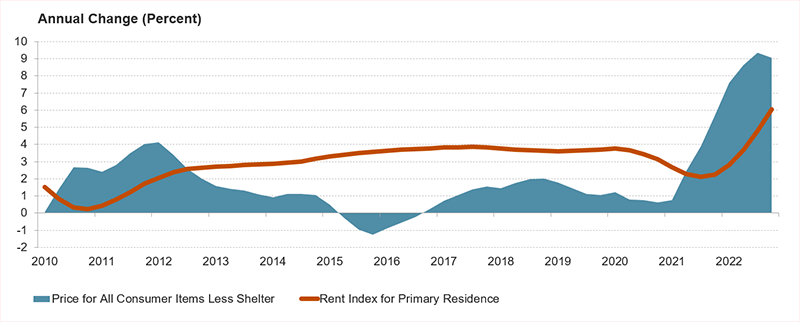

The Consumer Price Index shows the rapid rise in rents and the cost of other consumer goods and services. After a brief dip, rent growth accelerated through 2021 to a 6 percent peak in the last quarter of 2022 (Figure 1). This level of growth is especially notable because CPI’s rent measure is slow to move given that leases typically lock in rents for several months while the cost of other consumer goods (such as gas or food) can vary day to day. Meanwhile, the cost of all other consumer goods and services similarly increased at a rapid pace over this period, hitting a high of over 9 percent growth in the third quarter of 2022.

Figure 1: Rents and the Price of Consumer Goods Have Risen Rapidly

In light of rising inflation, the Census added questions to the Household Pulse Survey starting in July 2022 that asked whether respondents were sensitive to consumer price increases, how stressed they were about rising prices, and what financial strategies they were using to cope with inflation. The results point to the pressure households are facing as a result of the rapid increase in rents and the cost of other goods and services. Indeed, nearly all renter households (93 percent) reported that prices for goods and services had increased in their area in the two months before they were surveyed.

Between the rising cost of consumer goods and services and accelerated rent growth, renter households are feeling the pressure. A full 52 percent of all renters reported that recent price increases in consumer goods were very stressful while an additional 24 percent found them to be moderately stressful.

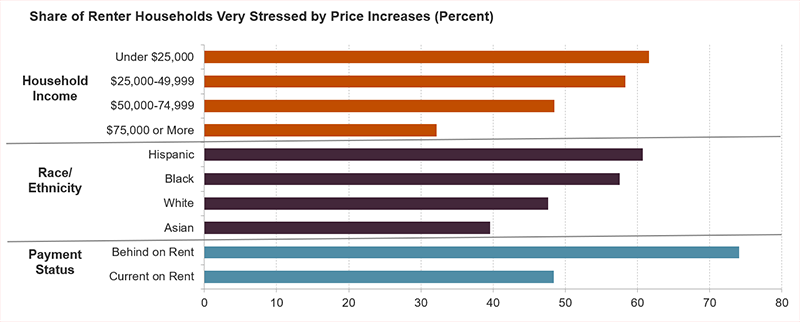

With fewer resources to weather economic shocks and inflation, lower-income households and households of color were most likely to indicate that consumer price increases were causing them stress. Among renters making less than $25,000, nearly two-thirds (62 percent) were very stressed (Figure 2). The share reporting this level of stress is lower for households with higher incomes. Even so, nearly a third of renters with incomes over $75,000 also felt that inflation was very stressful.

With lower median incomes due to persistent legacies of exclusion from and discrimination in job markets, Black and Hispanic households have been most likely to feel the pain of inflation. Indeed, a full 58 percent of Black households and 61 percent of Hispanic households were very stressed by recent consumer price increases, compared to 48 percent of white and 40 percent of Asian households. This pattern held across income categories with lower-income Black households facing the greatest rate of stress (69 percent).

Figure 2: Large Shares of Renter Households Are Feeling Very Stressed About Inflation

Renters who were behind on rent at the time they were surveyed also experienced inflation differently from those who were caught up. A slightly higher share of renters in arrears reported that consumer prices were increasing in their area. Being behind on rent shaped how stressed these renters felt about increasing costs. Nearly three-quarters (74 percent) of renters in arrears were very stressed about rising consumer prices, compared to just under half (48 percent) of those who were current on their rent payments.

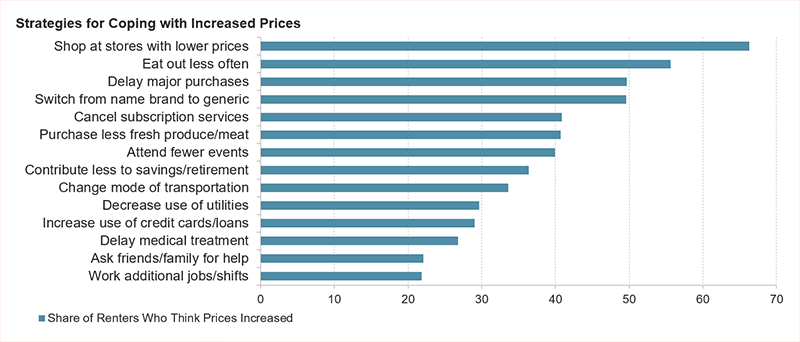

Renters who perceived that prices were increasing coped with this stress in a variety of ways (Figure 3). The most common strategy was shopping at stores with lower prices, looking for sales, or using coupons. Renters also cut back on how much they ate out, and many delayed major expenses or purchases. About a quarter of renters delayed medical treatment, and a slightly smaller share asked their friends or family for help. Just 7 percent of the renters who noted prices were increasing in their area moved to less expensive housing, perhaps speaking to both the cost of moving, the tightness of rental markets, and the lack of affordable options.

Figure 3: Renters Are Using a Range of Strategies to Cope with Rising Prices

As we noted in a previous blog, renters are left with a small and declining amount of income after paying their rent and utilities each month. And even before the pandemic, lower-income renter households who were severely burdened by housing costs spent less on food and healthcare than their unburdened counterparts. These tradeoffs have likely worsened with increased pressure due to rising rents and inflation. Continued support for the lowest-income renter households in the form of rental subsidies and income supplements will be crucial to ensure these households can meet a comfortable standard of living.