Homeownership’s Appeal Endures through the Housing Bust: A Key Question is Why?

The beating the U.S. housing market has taken in recent years inevitably raises the question: do people still want to own homes? Indeed, it would be surprising if the allure of owning hadn’t taken a hit, since owning has long been considered a safe and secure way to build wealth. But over the last few years, owning a home has been anything but a safe and secure investment. That said, a recent working paper I wrote with Rachel Bogardus Drew, analyzing data from Fannie Mae’s National Housing Survey on attitudes toward homeownership, concludes that there is little correlation between the extent of the downturn in housing and people’s attitudes toward homeownership. Overall, Americans continue to express very positive views of homeownership as a financial choice and many expect to own a home at some point in the future. Despite millions of foreclosures and trillions of dollars of lost housing wealth, homeownership appears to have retained its place as a key part of the American dream.

The study pools data from Fannie Mae’s National Housing Survey from mid-2010 through the fall of 2011. We examine how geographic variations in the extent of the housing bust are related to attitudes toward homeownership, using questions about whether respondents view owning as financially preferable to renting and whether respondents expect to buy a home at some point in the future (which is arguably a better overall indicator of whether homeownership is preferred).

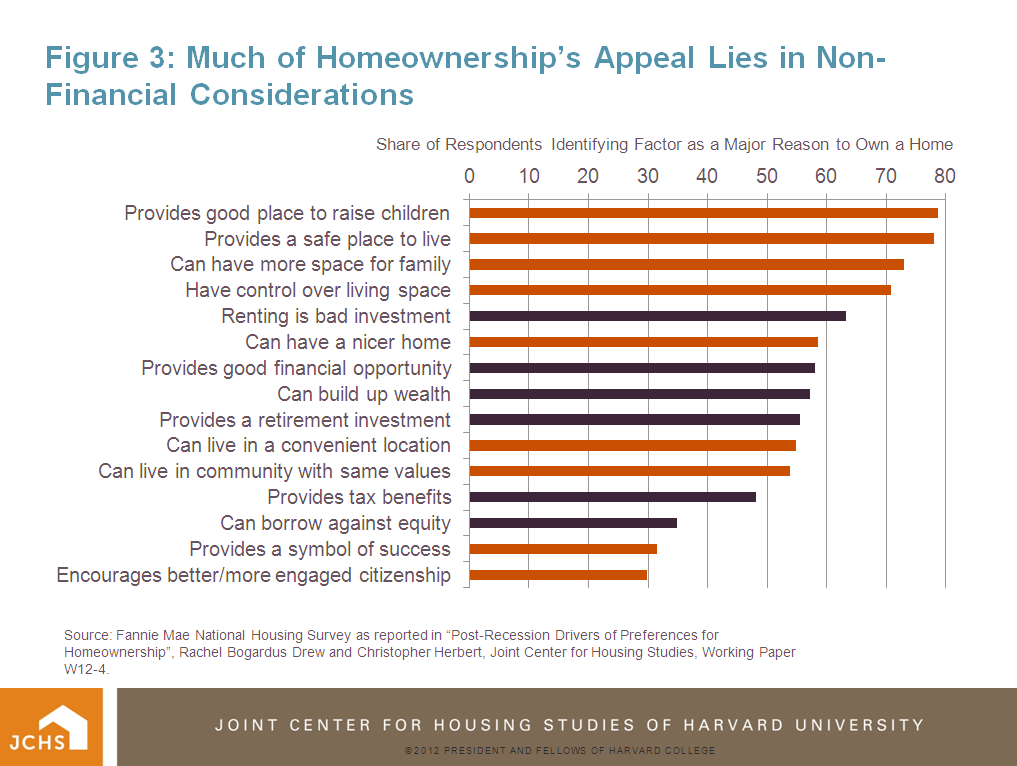

As shown in Figure 1, large majorities of respondents (over 85%) continue to feel that owning is a better financial choice than renting. Renters, households with annual incomes under $10,000, and those under age 25 are least likely to view owning more favorably, but even in these cases more than 7 out of 10 feel it’s a better financial choice. (Click charts to enlarge.)

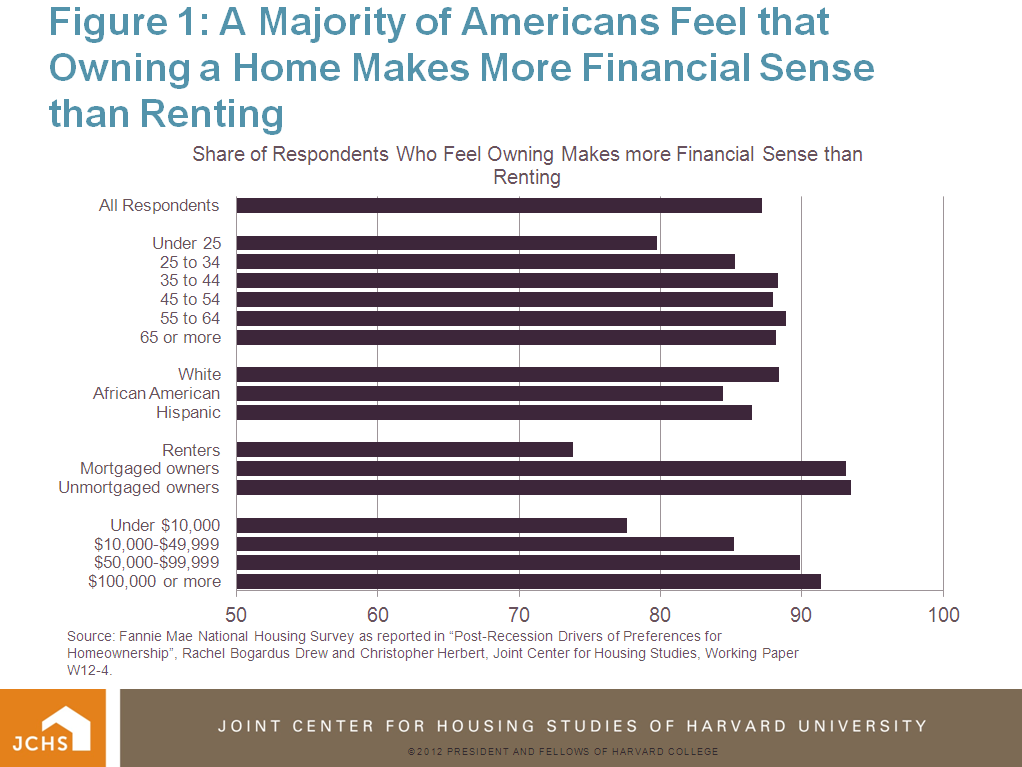

Meanwhile, almost 90 percent of respondents expect to own at some point in the future (Figure 2), with those most expecting to own being under the age of 45. Since 19 out of 20 of these younger adults expect to own a home at some point in the future, these results certainly do not suggest that positive attitudes toward homeownership have diminished. Of course, it may still be the case that there has been a change in the timing of moves into homeownership. During the boom, the sharp run up in house prices likely led many young people to jump into buying earlier than they might have. both out of a desire to share in the windfall profits that the housing market seemed to offer and out of fear of being priced out of the market if they waited too long to buy. Now that the bubble has burst, these premature moves to owning are less likely, with more young adults deferring buying during the time of life when they are likely to move more frequently to accommodate changes in jobs and family circumstances.

In the study we examine whether the responses to these questions are correlated with changes at the zip code level in house prices during the bust or the share of delinquent loans in the area. We also examine whether respondent’s views are associated with their own exposure to the housing crisis by knowing someone who is in default, has strategically defaulted, or whether they themselves are underwater on their mortgage. Our analysis found no association between house price declines and views toward homeownership. In fact, the only associations we found were that owners without a mortgage who were exposed to higher delinquency rates or knew a strategic defaulter were slightly less likely to view owning as financially preferred. We also found, perhaps not surprisingly, that owners who were underwater on their mortgages were somewhat less likely to expect to own again, although they were no less likely to view owning as being financially more favorable. Current renters, however, had no change in attitudes toward homeownership associated with any of these measures of distress.

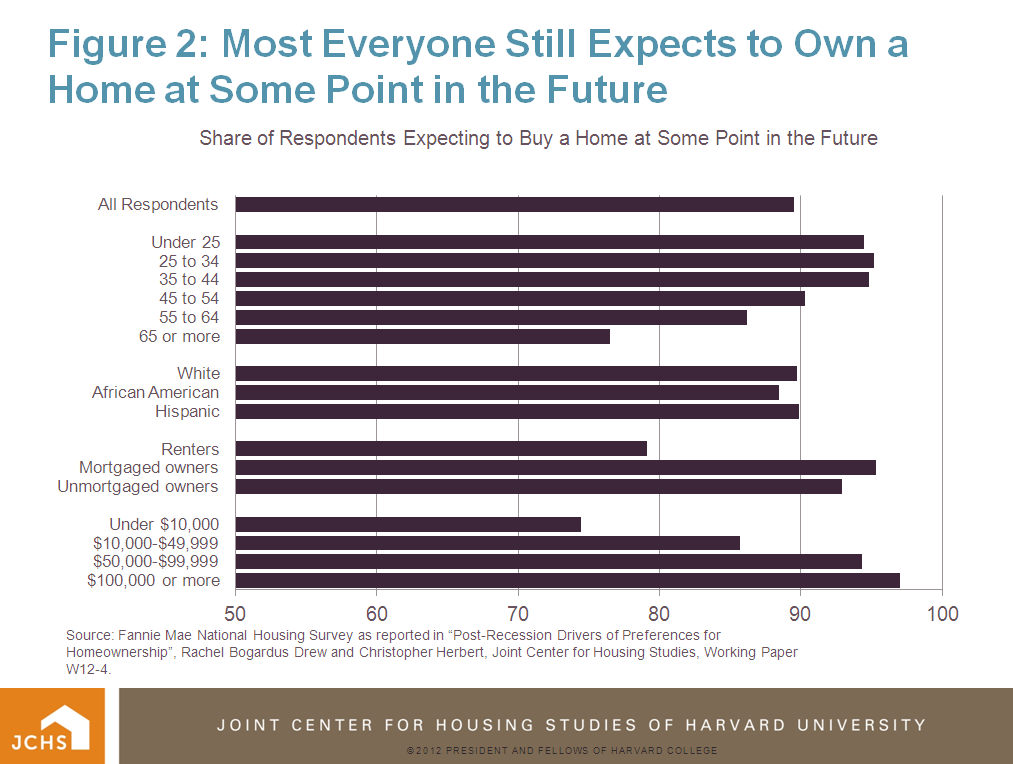

Of course, even though Americans overall continue to view ownership favorably from a financial perspective, buying a home is not purely a financial decision, and the non-financial factors are often overlooked in the discussion about homeownership’s continued appeal. While buying a home is the most significant financial decision that many people make in their lifetime, the choice of whether to own and which house to buy is ultimately a choice about the type of housing that best meets your family’s needs across a variety of dimensions: for daily living space, for a place to gather with family and friends, for the ability to change your home to suit your tastes, for the right to stay there as long as you like, for security and privacy, access to quality schools, and for a community where you can put down roots. In fact, when the Fannie Mae survey asks respondents to rate a range of factors related to whether owning is preferred, many of the most highly-rated factors are, in fact, not financial (see Figure 3). In the end homeownership’s enduring appeal may reflect the fact that the housing bust has not changed the consumer’s calculus in weighing these non-financial factors.