Homebuying Innovations Have Enabled the Strong Rebound in Home Sales

Innovations in the ways people search for, purchase, and finance homes have helped fuel a dramatic rebound in US housing markets. When the COVID-19 pandemic shuttered much of the national economy in the spring, there was a sharp drop in home sales across the country as real estate offices closed temporarily and home showings were cancelled. But homebuying bounced back considerably over the summer. One reason for the resurgence has been homebuyers and sellers alike adapting to changing circumstance and the adoption of innovative homebuying processes, including virtual showings, appraisals, and closings. These innovations have significantly streamlined the homebuying process and have the potential to disrupt housing markets into the future.

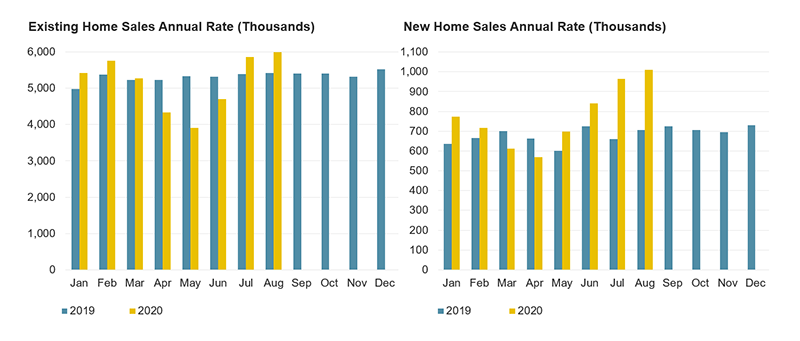

The drop in home sales in the spring had little precedent. On a month-over-month basis, existing home sales declined nearly 18 percent in April from the prior month, the third largest such decline since 1999. Compared to the prior year, existing home sales were down 27 percent in May, at a seasonally adjusted annual rate of 3.91 million units (Figure 1). Likewise, new home sales were down 13 percent annually in March and 14 percent in April.

Figure 1: Home Sales Nationally Plummeted in the Spring of 2020 Before Rebounding to New Cycle Highs Over the Summer

Note: Home sales are shown at the Seasonally Adjusted Annual Rate.

Source: JCHS tabulations of US Census Bureau, New Residential Sales; National Association of Realtors, Existing Home Sales.

But housing roared back late in the summer. August was the strongest month for home sales since 2006. Fully 6.0 million existing homes were sold at a seasonally adjusted annual rate according to the latest data, 10 percent above levels from 2019, despite the inventory of homes for sale tightening significantly. New home sales in August were up fully 43 percent at an annual rate of 1.0 million units, again the strongest recording since 2006.

The strength of the for-sale housing market in recent months is attributable to several possible factors. For one, ongoing demographic shifts—namely the continued aging of millennials into peak homebuying years—have also been an important tailwind. As a result, the share of first-time homebuyers ticked up in the summer, reaching 35 percent in June after averaging 29-32 percent from 2012 through the first two months of 2020.

The pandemic itself has also likely spurred some increased activity. Indeed, interest rates declined to historic lows as the US entered recession. Moreover, some of the millions of Americans suddenly working from home are likely reevaluating their housing needs, especially in terms of space, location, and affordability. Also, while the economic fallout from the pandemic has been widespread, job losses and income disruptions have been less common among higher-income households—those most likely to own and purchase homes. Lastly, in a typical year, homebuying peaks in the spring before it tails off later in the summer and declines in the fall and winter. By shuttering markets, the pandemic may have simply delayed some homebuying activity until later in the year.

But homebuyers and sellers also quickly adapted to new circumstances, and their behavioral shifts played a role in the rebound. For example, according to a National Association of Realtors (NAR) survey of over 3,000 realtors in May, 92 percent reported seeing behavior changes among sellers with active listings, and 76 percent reported changing behaviors among buyers when entering a home, including the use of hand sanitizer, masks, and handwashing. While it’s impossible to say how lasting these shifts will be, it’s likely that these behavioral changes persisted into the summer months and helped stabilize the housing market.

The rebound was also facilitated by changes in the homebuying process offered by key institutional actors—including realtors, lenders, and appraisers—that were quickly adopted by buyers and sellers. These changes include increased use of online searches and virtual showings, appraisals, and loan closings. In the same NAR survey, 35 percent of realtors in May reported sellers relying on virtual tours and 26 percent on virtual showings. Moreover, according to Zillow’s 2020 Urban-Suburban Market Report, site traffic for for-sale listings rose 42 percent year-over-year in June. This speaks to persistent demand for homeownership but also a growing preference for online searches that began before the pandemic but have since become more commonplace. In a 2019 report, NAR identified that 44 percent of homebuyers—a sizable plurality—began their housing search by looking at properties online, more than double the rate who contacted a real estate agent (17 percent) and quadruple the rate who looked online for information about the homebuying process (11 percent).

Similar innovations have occurred to allow more expedient loan closings and appraisals. Before the pandemic, home closings often involved face-to-face contact with a realtor, lawyer, and notary, among others. But in late March, the Federal Housing Finance Agency (FHFA) provided greater flexibility for homebuyers through alternative appraisal methods, including virtual and exterior-only appraisals for both purchase and refinance loans. The same FHFA guidelines also allowed remote online notarization in at least 45 states plus Washington DC.

The long-term impacts on the homebuying process are still to be determined, but the pandemic could accelerate a trend towards increased digitization and use of technology in homebuying. Perhaps the most extreme form of this in recent years has been the use of iBuyers, technology-based firms that offer cash to home sellers before quickly reselling the property at a markup. iBuyers, which include Opendoor, Offerpad, and Zillow Offers, use algorithm-driven automated valuation models to determine the value of the home and ultimately the offer price. By foregoing the extra cash that would come from traditional marketing, sellers benefit from not having to make repairs to the home as well as the certainty and brevity of the transaction. While iBuying has the potential to disrupt the market, CoreLogic estimated that iBuyers accounted for only about 1 percent of home sales in the markets they operated in, in 2018. iBuyers were most common in markets with relatively new, standardized housing stocks, comprising as much as 5 percent of transactions in the city of Phoenix, 3 percent in Las Vegas, and 3 percent in Raleigh. iBuyers had almost no presence in the Northeast and very little, outside Minneapolis, in the Midwest.

The pandemic has certainly spurred adaptations and innovations in the homebuying and selling space. Whether these changes prove long lasting will depend on how much they improve the experience for buyers and sellers, their adoption by industry, and, in some cases, changes to policy that would enable and encourage their continued use.