Designing a Nationwide Downpayment Assistance Program: Lessons from Five International Case Studies

Downpayment assistance has, of late, received an increasing amount of attention among US policymakers. President Biden proposed a nationwide downpayment tax credit during his 2020 presidential campaign, and since then two bills related to downpayment assistance have been discussed in the House.

Given this increasing attention, policymakers seeking to design a national downpayment assistance program would do well to study the experience of their international counterparts.

In my new Center working paper “Designing a Nationwide Downpayment Assistance Program: Lessons from Five International Case Studies,” I review the design and implementation of national downpayment assistance programs in five countries: Ireland, England, Canada, Australia, and New Zealand. I then draw on the reviews to make five recommendations for US policymakers.

The paper aims to assist policymakers in two ways. First, it analyzes the successes and failures of each of the five countries examined. Second, it extracts from the international examples a synthesized list of ‘design choices’ that policymakers must consider as they design a downpayment assistance program in the US.

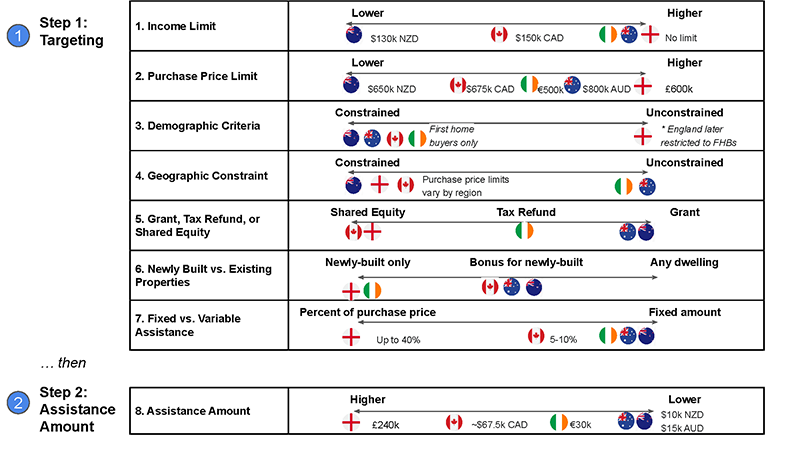

Specifically, the paper identifies eight ‘design choices’ for a future downpayment assistance program (Figure 1). These choices include: access restrictions to the program (based on income, purchase price limits, or demographic criteria such as first-home-buyer status); the financial structure of the program (grants, tax credits, or shared equity); and the amount of assistance provided. Each of the design choices fall on a linear spectrum between making a program more tightly targeted or more broadly accessible. Policymakers can consider this list a menu of options from which to design a program.

Figure 1: Design Choices

The key insight of the paper is that policymakers face a primary design challenge: in order to increase the rate of homeownership, downpayment assistance should only flow to those who would not have achieved homeownership without it. While this seems obvious, an examination of the international case studies shows that in many instances, political pressure to expand the scope of the programs meant that assistance was provided to homebuyers who would have achieved homeownership without any help. In these cases, government funds may have worsened housing affordability by inflating demand and driving prices higher.

Based on this insight, five recommendations are made to US policymakers:

- Make design choices that will tightly target the program, thus ensuring that recipients are those who need it most.

- Be cognizant of the political costs of a tightly targeted program, and mitigate these costs by clearly defining the objectives of the program.

- Be deliberate in the level of assistance provided.

- Tie the program to new housing supply.

- Deploy the program using a simple, unified, and nationwide approach.

By taking these steps, policymakers will be choosing from the best elements of the international programs and will thus be closer to deploying an effective program in the United States.