Cash-Strapped During COVID-19

The COVID-19 pandemic began at a time when many Americans were already struggling to make ends meet, with an affordability crisis leaving many burdened by the rising costs of housing. For many households, the pandemic has meant a sudden loss in income, which may force them to draw down their savings to pay for large, essential expenses like housing. Unfortunately, many Americans do not have sufficient savings to weather this storm. Over 15 percent of homeowner households and nearly half of renter households had less than $1,000 in cash savings in 2016, which is roughly the national median housing cost, according to data from the Federal Reserve and the Census Bureau. Low-income renters, who are disproportionately black or Hispanic, are living on a particularly thin margin and are especially vulnerable to financial distress and housing insecurity during and after this pandemic.

One way to assess financial readiness is to ask how households would handle unexpected expenses. The Federal Reserve’s Survey of Household Economics and Decisionmaking (SHED) asks whether a household could afford an unexpected expense of $400 using cash, savings, or a credit card paid off at the next statement. According to the most recent SHED report, 39 percent of Americans could not afford that hypothetical expense in 2018. Some portion of this group may have sufficient cash savings but not be willing to draw from it for this expense.

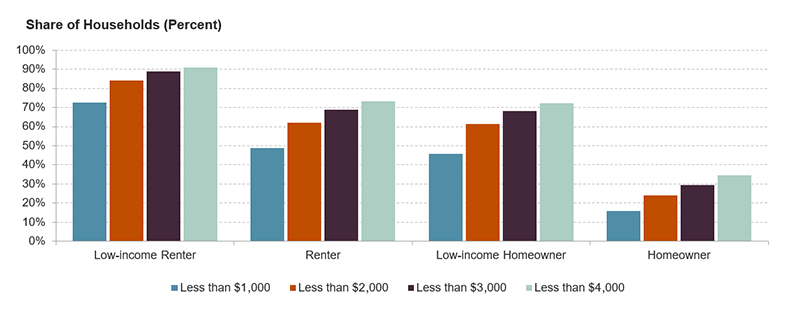

According to the Federal Reserve’s Survey of Consumer Finances (SCF), the median amount in cash savings (the sum of checking, savings, CDs, and money market accounts) for homeowners in 2016 (the most recent available data) was $9,000. This roughly means that the typical homeowner household had just under nine months of housing costs in savings, based on the most recent American Community Survey data. Nearly half of renter households, however (49 percent) had less than $1,000 in cash savings in 2016, according to SCF data. Additionally, well more than half of renters (62 percent) had less than $2,000 in cash savings, 69 percent had less than $3,000, and 73 percent had less than $4,000. Even for the highest of these thresholds, homeowners were much better off; only 34 percent of homeowner households had less than $4,000 in cash savings. Given that the quarantines in many states are reaching their two-month mark, we can expect growing shares of all households—but especially renters—to have used much of their cash savings to pay for housing.

Those who have been least able to save are the most financially vulnerable in these volatile times, and the households with the smallest cushion are low-income renters. Whereas 46 percent of homeowner households in the lowest income quartile had less than $1,000 in cash savings in 2016, 73 percent of renter households in the lowest income quartile had less than $1,000. 84 percent of the lowest-income renters had less than $2,000 in cash savings, rising to 89 percent with less than $3,000, and 91 percent with less than $4,000 (Figure 1). Renters in the lowest income quartile had a median of $200 in cash savings in 2016. Even with the $1,200 CARES Act payment from the federal government, these households likely have less than two months’ worth of housing costs (not considering all other essential expenses) as a financial buffer.

Figure 1: Majority of Renters and Low-Income Homeowners Have Less than Four Months’ Worth of Cash Savings

Notes: Low-income homeowners and low-income renters are in the lowest income quartile of all households. Cash savings are defined as the sum of amounts in checking, savings, CDs, and money market accounts. National monthly median housing costs were $1,000 for all renters and $1,100 for all homeowners in 2018 (Source: JCHS tabulations of US Census Bureau, ACS 1-Year Estimates), meaning that these cash savings thresholds roughly equate to months of housing costs.

Source: JCHS tabulations of Federal Reserve, 2016 Survey of Consumer Finances.

COVID-19 has disproportionately affected people of color, and it is likely that the economic ramifications will too, as households headed by people of color are disproportionately represented among lowest-income renters. While black households accounted for 12 percent of all US households in 2018, and Hispanic households accounted for 14 percent, black households represented 25 percent of lowest-income renter households, and Hispanic households represented 20 percent. Additionally, 62 percent of black renter households and 61 percent of Hispanic renter households had less than $1,000 in cash savings in 2016, compared to 39 percent of white renter households.

These findings are especially concerning in light of the other options available to households who have used up their savings. When asked in a 2019 survey how they would pay for essentials if they missed paychecks and had no savings, nearly half the respondents said they would use their credit cards or borrow money from family or friends (the answers were not mutually exclusive), but around one-quarter would withdraw from retirement funds or skip payments on essential bills, actions that often carry a financial penalty. Almost one-fifth of respondents would take out a payday, auto, or short-term loan, which typically have very high interest rates. While the CARES Act payment and other supports like unemployment insurance will help fill the gap, many households will be forced to resort to measures that could harm their financial stability in the long-term. Without further federal support, housing for many families could be jeopardized, in large part because of the thin margin on which many Americans live.