Addressing the Housing Insecurity of Low-Income Renters

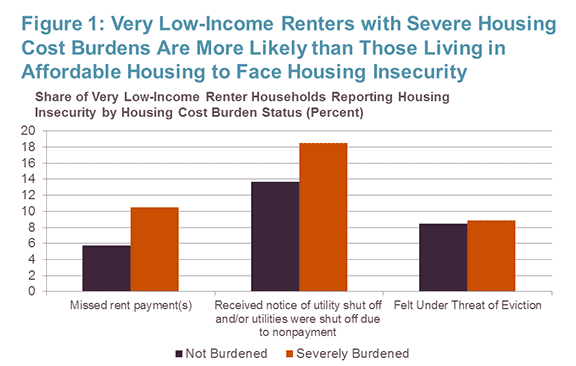

As our recently released 2016 State of the Nation’s Housing report highlights, rental housing affordability remains a pervasive—and growing—problem for millions of renter households in the US. The number of renter households devoting more than half of their income to housing costs (those considered severely burdened) climbed to a record high of 11.4 million in 2014. Among renter households earning under $15,000 a year, severe cost burdens are widespread, with 72 percent falling into this category. Severe cost burdens can adversely impact the housing security of very low-income households, leaving them little money left over to pay for necessities or to cover unexpected expenses. Indeed, compared to those with similar incomes who live in housing they can afford, very low-income renters paying more than half of their income on housing in 2013 were nearly two times more likely to fall behind on their rent, were at higher risk of having their utilities being shut off due to nonpayment, and were more likely to believe that they would be evicted within the next two months—all elements of housing insecurity (Figure 1).

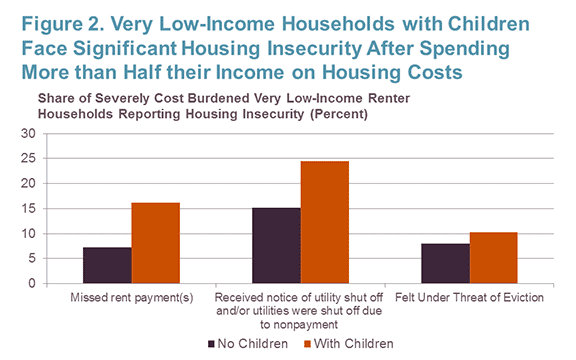

Furthermore, very low-income renter households with children are also more likely than those without children to be housing insecure and believe that they are at risk for eviction (Figure 2). Eviction is a leading cause of homelessness for families with children living in major cities like Washington, DC, Philadelphia and Baltimore, according to the most recent US Conference of Mayors Hunger and Homelessness Survey. As I point out in a previous blog post, homelessness among people in families with children persists in the highest-cost cities even as homelessness continues to decline steadily among veterans and those with chronic patterns of homelessness.

Permanent federal housing subsidies that account for changes in tenant incomes, such as housing choice vouchers, have proven to be the best option for improving housing stability, especially among homeless families exiting shelter. However, spending on federal housing assistance remains scarce, with direct housing subsidies representing just 4 percent of total discretionary funding approved by Congress in FY2015, a share that has barely budged over the past two decades.

Given the scarcity of federal funding, how can we address financial instability among low-income renters and reduce housing insecurity among this group? Enterprise recently proposed a promising master lease model program with built-in tenant savings accounts that could, without federal subsidies, improve the stability of low-income renters. Under this program, rents would remain affordable because a nonprofit or mission-driven organization would obtain long-term access to units in existing buildings through a multi-year master lease arrangement with fixed prices similar to the ones used for commercial leases. Unique to this model is a savings component in which a small amount of money from a tenant’s monthly lease payment would be allocated toward a custodial account in the tenant’s name. Tenants would not only have stable housing costs but would also be able to accumulate a savings cushion to pay for unanticipated expenses such as emergency room visits, and bounce back from income disruptions such as involuntary job loss or a significant reduction in income. In fact, a recent Urban Institute report analyzing data from the Census Bureau’s Survey of Income and Program Participation panel found that low-income families with savings of at least $2,000 to $4,999 are more financially resilient than middle-income families without any savings. Among low-income families with savings of $2,000–$4,999, just 20 percent experienced hardship after an income disruption, compared to about 30 percent among middle-income families without any savings.

However, financial issues are not the only contributor to housing insecurity among low-income households—some households may also struggle with additional challenges such as domestic violence, former incarceration, and mental health and substance abuse issues. As a result, improving housing insecurity may also require expanding access to supportive services that help address these underlying issues.

The MacArthur Foundation’s annual How Housing Matters Survey released last month confirms that a majority of Americans have a grim outlook on housing affordability—81 percent of respondents stated that they believe housing affordability is a problem in America today. Nearly seven in ten adults responded that it is more challenging to secure stable, affordable housing today than it was for previous generations. Furthermore, a recent Gallup poll found that 63 percent of renters with annual household income of less than $30,000 were worried about being able to pay their rent or other housing costs. Existing proposals to increase the number of affordable rentals built or preserved through the Low Income Housing Tax Credit program, and to reform federal rental assistance programs in order to serve more low-income households, can help alleviate the rental affordability crisis. However, it is equally important to offer programs that can help low-income renters better weather income disruptions or unexpected financial emergencies and avoid missed rent payments that can lead to eviction.