Discrimination in Home Lending and Appraisals: Challenges for Black Homebuyers in Massachusetts

Since 2019 I have conducted research on how rising housing prices in Boston displace long-time residents and the impacts on smaller cities and towns on the edge of the larger metropolitan area. As a case study, I have studied Brockton, a post-industrial city south of Boston that has become popular among Black immigrant homebuyers and which became New England’s first majority Black city. Last week, I was honored to share some of my findings with Boston City Council’s Committee on Civil Rights and Immigrant Advancement, which held a hearing on discrimination in lending and appraisals. In my testimony, I discussed four key challenges for Black homebuyers in Massachusetts.

First, during the pandemic, a growing number of Black and Hispanic households became homeowners, and we saw a similar marked increase in the number of Black homebuyers here in Massachusetts. Indeed, from 2018 to 2021, the number of Black homebuyers with a mortgage across the state increased by 40 percent, while the number of white homebuyers remained stable across this period (Figure 1). In 2018 Black buyers constituted 4.9 percent of all homebuyers in Massachusetts, while by 2021 this share had risen to 6.2 percent. Even as Black households remain underrepresented among homebuyers, the last few years have been a relatively good period for homeownership gains among Black households in Massachusetts.

Figure 1: Throughout the Pandemic, Homebuyers of Color Made up a Growing Share of All Homebuyers in Massachusetts

| 2018 | 2021 | Percentage Change | |

|---|---|---|---|

| White | 54,280 | 54,455 | 0.3% |

| Black | 3,543 | 4,959 | 40.0% |

| Hispanic | 6,452 | 9,260 | 43.5% |

| Asian and Pacific Islander | 7,291 | 9,813 | 34.6% |

| Multiracial | 667 | 867 | 30.0% |

| Total Loans | 72,223 | 79,354 | 9.9% |

Second, however, most of these Black homebuyers were not buying in the city of Boston. During this period, there was in fact a slight dip in the share of Black homebuyers who were buying within the city. While many Black Bostonians express a desire to stay and become homeowners in their city, they were increasingly priced out of Boston, and now make up an ever-smaller share of all Boston homebuyers.

Third, and by contrast, most Black homebuyers in Massachusetts were buying in a select few cities and towns south of Boston, notably in Brockton, Randolph, Taunton, and Stoughton (Figure 2). Our data show that that racial segregation is increasing, as cities like Brockton become increasingly Black, in the midst of places like Plymouth County which remains overwhelmingly white.

Figure 2: The Share of Homebuyers Who are Black is Falling in Boston, but Rising in Select Places South of Boston

| Share Black Buyers | ||

|---|---|---|

| 2018 | 2021 | |

| Massachusetts | 4.9% | 6.2% |

| Boston | 6.6% | 6.2% |

| Brockton | 55% | 64% |

| Randolph | 39% | 39% |

| Stoughton | 24% | 28% |

| Taunton | 20% | 31% |

| New Bedford | 11% | 19% |

| Fall River | 12% | 25% |

Over time, growing shares of Black buyers in only a few places outside of Boston could create segregated cities and towns, which could foster new inequalities. If white homebuyers avoid buying in these segregating cities, future home-price appreciation may lag, which would limit wealth-building for Black homeowners. Moreover, segregating cities like Brockton also face the costs of an aging infrastructure, the burdens of abandoned industrial and commercial sites, problems with urban violence, and school systems stretched by the needs of first-generation immigrant and lower-income students. Segregation concentrates these issues and their costs in communities of color, which in turn perpetuates racial inequalities in local resources and opportunities.

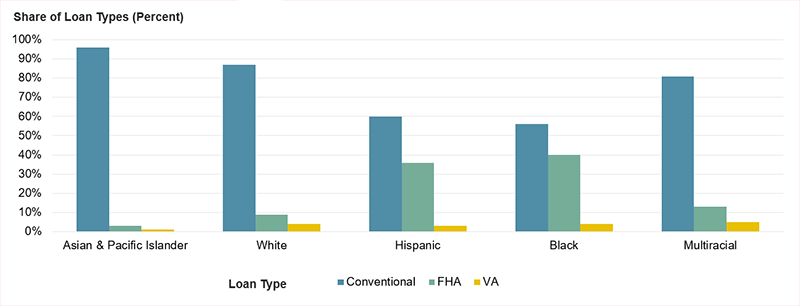

Finally, Federal Housing Administration (FHA) loans continue to play a key role in enabling homeownership for Black homebuyers in Massachusetts. Indeed, from 2018 to 2021, 40 percent of Black homebuyers in the state who used a mortgage bought a home with an FHA mortgage: much higher than the 9 percent of white homebuyers who relied on an FHA loan (Figure 3).

Figure 3: Black and Hispanic Buyers Disproportionately Rely on FHA Loans to Buy Homes in Massachusetts

FHA loans are government-backed loans that target first-time homebuyers, require a low, 3.5 percent downpayment, and do not have risk-based pricing, which often makes them the most affordable option for buyers with lower credit scores. Nonetheless, I have two concerns about how racial discrimination can happen with FHA loans.

First, Black homebuyers who would qualify for a conventional loan and for whom it may be a better option, may end up with an FHA product instead. Facing higher denial rates, they may be pushed towards an FHA product. If this happens, they ultimately pay more for a mortgage than they should, as FHA requires a Mortgage Insurance Premium for the life of the mortgage.

Second, my research has unearthed concerns around how welcomed FHA mortgages are in competitive housing markets around Boston. Especially in tight housing markets, FHA buyers struggle to compete with buyers making cash offers or waiving contingencies. I have also found that some sellers and their realtors stigmatize FHA buyers, perceiving them as less reliable, fearing that the transaction may fall through, or wanting to avoid the bureaucracy of an FHA inspection and appraisal. This stigma of FHA in competitive markets may introduce additional challenges for Black homebuyers, who disproportionately rely on FHA loans.

While the last few years have brought encouraging gains to Black homebuying in Massachusetts, we also have new concerns: notably about the diminishing share of Black homebuyers in Boston itself, about growing racial segregation in cities and towns around Boston, and about who gets an FHA mortgage and where they are able to buy with FHA.