Black and Hispanic Renters Face Greatest Threat of Eviction in Pandemic

The COVID-19 pandemic and resulting recession have worsened existing disparities in housing affordability. For renter households of color, already saddled with higher housing cost burdens, the pandemic delivered a devastating financial blow. Black and Hispanic renter households in particular were twice as likely as white renter households to be behind on housing payments and twice as likely to report being at risk of eviction.

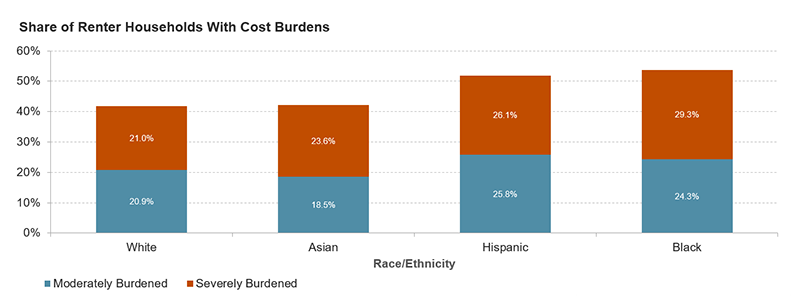

As noted in our recent report, The State of the Nation’s Housing 2020, over half of Black and Hispanic renter households were cost burdened going into the pandemic, compared to 42 percent of Asian and white households (Figure 1). Black renter households were the most likely to be severely cost burdened, spending over 50 percent of their income on housing. While 21 percent of white renter households were severely cost burdened in 2019, representing 4.8 million households, 29 percent of Black renter households, or 2.5 million households, were severely burdened. In addition, 26 percent of Hispanic renter households, or 2.3 million households, and 24 percent of Asian renter households, or 556,000 households, were severely burdened.

Figure 1: In 2019, Over Half of Black and Hispanic Renter Households Were Cost Burdened

Notes: Cost-burdened households pay more than 30% of income for housing. Households with zero or negative income are assumed to have burdens, while households paying no cash rent are assumed to be without burdens. White, Black, and Asian households are non-Hispanic. Hispanic households may be of any race.

Source: JCHS tabulations of US Census Bureau, American Community Survey 1-Year Estimates

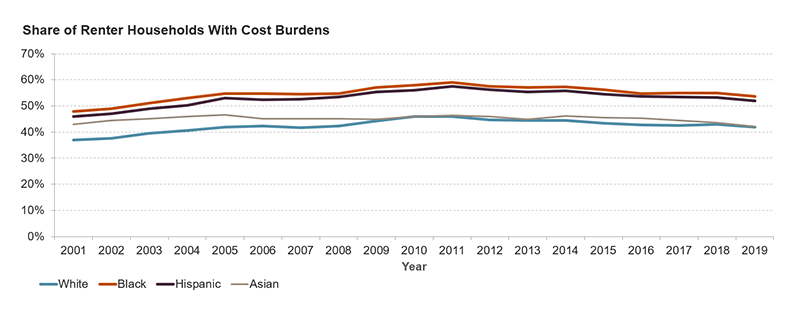

Moreover, the difference in cost burden rates by race and ethnicity has not moderated over time (Figure 2). There was an 11 percentage point difference between Black and white renter households in 2001, rising slightly to 12 percentage points in 2019. The difference between Hispanic and white households similarly rose from a 9 to a 10 percentage point difference over this period.

Figure 2: The Race Gap in Cost Burdens Has Widened Since 2001

Notes: Cost-burdened households pay more than 30% of income for housing. Households with zero or negative income are assumed to have burdens, while households paying no cash rent are assumed to be without burdens. White, Black, and Asian households are non-Hispanic. Hispanic households may be of any race.

Source: JCHS tabulations of US Census Bureau, American Community Survey 1-Year Estimates

The gaps in cost burdens are due to both labor market inequities that result in lower wages and housing market inequities that result in higher housing costs for households of color. In 2019, the median income of Black renter households was $32,140, compared to $42,000 for Hispanic renter households, $45,000 for white renter households, and $62,220 for Asian renter households. Despite having similar median rents, research has illustrated that Black households in particular pay more for comparable housing, contributing to the racial disparity in housing cost burdens.

The financial impacts of the pandemic and resulting recession have also fallen disproportionately on Black and Hispanic renter households and will likely widen racial and ethnic inequities in housing affordability. As businesses shuttered and many high-contact industries shed jobs, Hispanic and Black renters were the most likely to lose employment income. As of late September, 59 percent of Hispanic renter households and 53 percent of Black renter households reported income losses since mid-March, according to our analysis of the Census Bureau’s weekly Household Pulse Survey. By comparison, just 45 percent of white households and 43 percent of Asian households reported losing income.

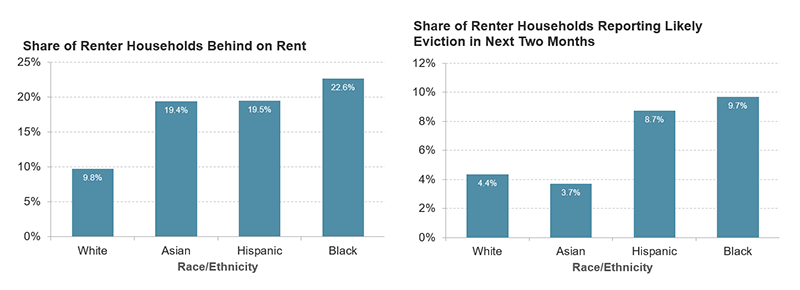

Because Black and Hispanic households had lower incomes and less savings when the pandemic hit, they have had a harder time keeping up with rent payments. Black households were more than twice as likely as white households to be behind on rent; nearly 23 percent of Black renter households reported that they were not caught up at the time of the survey. Similarly, 20 percent of Hispanic renter households and 19 percent of Asian renter households were behind on their housing payments (Figure 3).

Figure 3: Black Renter Households Are the Most Likely to Be Behind on Rent and at Risk of Eviction

Notes: Households behind on rent or mortgage reported that they were not caught up at the time of survey in late September. White, Black, and Asian households are non-Hispanic. Hispanic households may be of any race.

Sources: JCHS tabulations of US Census Bureau, Household Pulse Survey, Week 15

A staggering 9.7 percent of Black renter households and 8.7 percent of Hispanic households reported that they were very likely to be evicted in the next two months. This is significantly higher than what white (4.4 percent) and Asian (3.7 percent) households reported. In total, the survey suggests that more than a million Black and Hispanic households anticipated eviction in the next two months. And while there has been some federal action aimed at offsetting income losses and delaying a potential wave of evictions, these responses may not meet the long term needs of renter households. The eviction moratorium in the second COVID-19 stimulus package does not end the obligation to pay back rent and is set to expire on January 31st. Even during the preceding eviction moratorium issued by the CDC, evictions were still occurring by the thousands.

With eviction protections and unemployment benefits set to run out, a comprehensive national response is needed to keep at-risk renters in their homes. In the absence of substantial policy interventions, it is inevitable that housing cost burdens will increase following the pandemic, especially for renter households of color.