Affordability Challenges for Low-Income Homeowners Have Intensified During the Pandemic

The newly released American Community Survey (ACS) shows a continued decrease in cost burdens in 2019. While the share of all homeowners that were cost-burdened (spending more than 30 percent of their income for housing) fell significantly in the decade before COVID-19, there were only slight declines in cost burdens for low-income homeowners. These longer-term trends are especially worrisome because low-income households are much more likely to have lost jobs or had their work curtailed since the pandemic began.

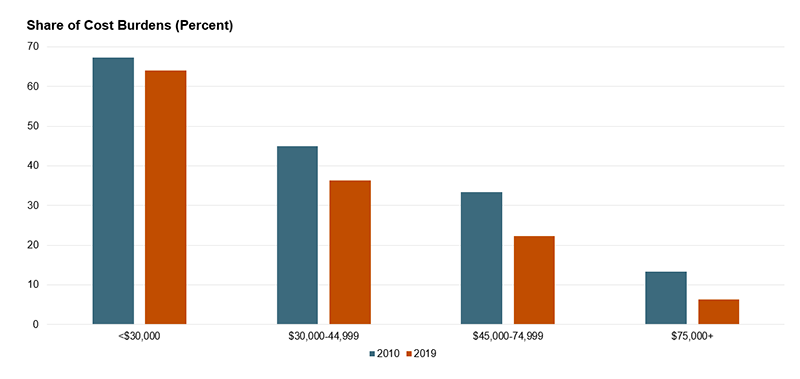

Last year, the overall cost burden rate for homeowners declined from 30 to 21 percent since 2010, the lowest levels since 2000. However, as the Center’s recent State of the Nation’s Housing 2020 report has highlighted, many households are still burdened by housing costs [Interactive Map], and low-income homeowners most in need of relief saw few declines in cost burdens. In 2010, 67 percent of homeowners with household incomes of $30,000 or less were cost-burdened and in 2019 this percentage only slightly decreased to 64 percent. Severe cost burdens among these homeowners (spending more than 50 percent of income on housing) had a similar decline, from 46 to 43 percent.

Figure 1: Owner Cost Burden Rate by Income Category, 2010-2019

Source: JCHS tabulations of US Census Bureau data, American Community Survey data, 1-year estimates.

While low-income households saw only slight cost burden declines, higher-income cost burdens declined by more than half. In 2010, 13 percent of homeowners with real median household incomes of $75,000 or more were cost-burdened. By 2019, this number had declined by more than half, to just 6 percent. Additionally, homeowners with incomes between $45,000 to $74,999 saw declines in cost burdens from 33 to 22 percent.

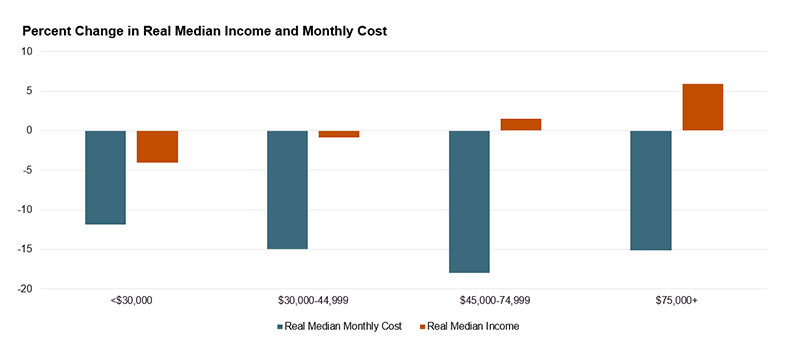

The unequal distribution of declining cost burdens is being driven by significantly larger growth in incomes and larger declines in monthly cost for high-income homeowners compared to low-income homeowners. From 2010-2019, real median income decreased by 4 percent for households making less than $30,000 and median housing costs for these households decreased by 12 percent. For households making $75,000 or above, however, median incomes increased by 6 percent and median housing costs decreased by 15 percent.

Figure 2: Percent Change in Owner Real Median Income and Monthly Cost by Income Category, 2010-2019

Source: JCHS tabulations of US Census Bureau data, American Community Survey 1-Year Estimates via IPUMS.

The ACS data also show significant differences in the age, race, education, and location of low-income homeowners: low-income homeowners are more likely to be older, live in the South, be people of color, and have no more than a high school education.

Homeowners with household incomes below $30,000 were disproportionately households of color. Twenty-six percent of Native American homeowners had household incomes under $30,000, while 22 percent of Black homeowners had household incomes under $30,000. Sixteen percent of Hispanic homeowners had household incomes under $30,000 and 15 percent of white homeowners had household incomes under $30,000. Asian homeowners had the lowest percentage of low-income homeowners at 9 percent.

Additionally, low-income homeowners are significantly more likely to be 65 or older. In 2019, 55 percent of households making under $30,000 were 65 years of age or above, and only 22 percent of homeowners making $75,000 or above were 65 or older. Older households also experienced the least amount of cost burden declines among age groups. Cost burdens for homeowners 65 or over decreased by 4 percent from 2010-2019, while homeowners between the ages of 35-44 saw the largest declines of cost burdens at 15 percent.

Low-income homeowners were also almost twice as likely to reside in the South than in any other US region. In 2019, 46 percent of homeowners making less than $30,000 were located in the South, despite the fact that only 39 percent of total homeowners live in the South. The region with the second highest percentage of low-income homeowners was the Midwest at 23 percent, almost half of the percentage of low-income homeowners in the South. Eighteen percent of the lowest income homeowners reside on the West Coast and 14 percent reside on the East Coast.

Low-income homeowners are also less likely to have a bachelor’s degree. In 2019, 40 percent of all homeowners had a bachelor’s degree or higher, while the same was true for only 16 percent of the lowest income homeowners. Meanwhile, 54 percent of those with household incomes of $75,000 or more had a bachelor’s degree or higher.

For low-income households who were already vulnerable to economic shocks, the pandemic has exacerbated difficulties. Cost-burdened households are more likely to be low-income and work retail and service jobs that put them at higher risk of exposure to COVID-19. Forty percent of households (5.2 million) whose wages came exclusively from at-risk jobs including service, retail, and transportation were cost-burdened compared to 22 percent of households (13.1 million) whose income came from other types of jobs. Homeowners with at-risk jobs also have a greater risk of termination or reduction in hours. A substantial decline in wages for an extended period would present major affordability challenges for these homeowners, in addition to heightened foreclosure risk.

While declining cost burdens for middle- to higher-income homeowners is a positive development for many, low-income households remain disproportionately cost-burdened and vulnerable to economic shocks, underscoring the need for homeownership programs and policies that not only provide initial access to homeownership to first time buyers, but help provide the support needed for low-income households to maintain secure and sustainable homeownership. Mortgage payment subsidies, interest rate reductions, downpayment assistance, and other supports that reduce monthly costs or increase incomes can play a key role in reducing cost burdens for low-income homeowners.