Recent Upturn in DIY Remodeling Projects Unlikely to Continue Long-Term

During the pandemic, there has been a surge in do-it-yourself (DIY) home improvement as people have used some of their extra time at home to undertake projects that accommodate changes to their lifestyle. While the overall home improvement market is expected to remain strong in the future, it is likely that this surge in DIY activity will fade and return to more normal levels.

Given that people have been spending more time in their homes in recent months and expanding their at-home activities for things such as work, schooling, exercise, and outdoor entertainment, many homeowners who have not been adversely affected financially by the recession have been active in upgrading their homes to accommodate their evolving needs. This level of project activity contrasts with the typical pattern of discretionary home improvement spending, which tends to decline during economic downturns and accelerate during upturns.

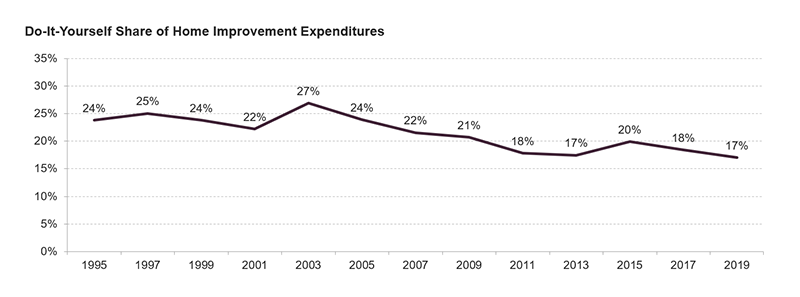

While there has been strong interest in home improvement projects during the pandemic, a surprisingly large share of this activity has been undertaken by homeowners themselves. A series of consumer surveys by The Farnsworth Group and the Home Improvement Research Institute (HIRI) indicate that, early in the pandemic, fully 60 percent of homeowners reported that they recently started a DIY home maintenance, replacement, repair, or remodeling project, and the share grew to almost 80 percent by early June 2020 (Figure 1). When asked why they undertook these projects, the most common responses were that they had more spare time (84 percent), were home more often (81 percent), doing the projects themselves saved them money (34 percent), and they didn’t want contractors in their home (21 percent).

Figure 1: Most Homeowners Started New DIY Projects During the Pandemic

Notes: Based on weekly homeowner surveys. Approximately 850 owners responded each week, for total response of almost 10,000 homeowner responses over the survey period.

Notes: Based on weekly homeowner surveys. Approximately 850 owners responded each week, for total response of almost 10,000 homeowner responses over the survey period.

Source: JCHS tabulations of The Farnsworth Group-Home Improvement Research Institute, COVID Home Improvement Impact Tracker, 2020.

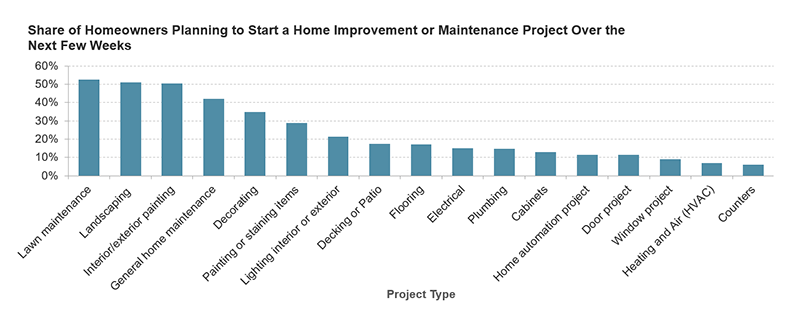

However, this increase in DIY activity during the pandemic is at odds with a longer-term trend of a declining DIY share of homeowner spending on home improvement projects. In recent years, fewer than one in five dollars spent annually on home improvement projects (as opposed to more routine maintenance and repair) were for a DIY project according to our analysis of the American Housing Survey. This is down from two decades ago, when roughly one in four dollars spent was on a DIY project (Figure 2).

Figure 2: The DIY Share of Homeowner Improvement Expenditures Has Been Trending Down for Many Years

Notes: Data includes home improvement projects undertaken by homeowners. Expenditures for DIY projects are for materials only.

Source: JCHS tabulations of HUD, American Housing Surveys.

There are many reasons for the longer-term decline in DIY home improvement spending. Growing household incomes encourage more owners to hire professional contractors. Lower rates of mobility, particularly for younger households who more commonly undertake these projects when they move, limits opportunities for DIY projects. Further, more complicated materials and products used in the typical home today often discourages homeowner installation. Finally, a general declining interest in, and exposure to, manual labor among much of the population limits their desire to attempt DIY projects.

However, likely the most critical factor is that our owner population is getting older. In 1995, 26 percent of owner households nationally were age 65 or older. As the baby boom generation has aged, by 2019 over 32 percent of owners were 65 or older. Our research has determined that owners 65 or older spend, on average, only 12 percent of their home improvement dollars on DIY projects. Owners under age 35, by contrast, spend almost a third of their home improvement expenditures on these projects, while owners age 35 to 44 spend over 20 percent.

It is not only potential physical limitations that encourage older owners to undertake fewer DIY home improvements. Older owners typically undertake a different mix of projects as well, disproportionally focusing their home improvement activity on exterior replacement projects (roofing, siding, window replacements, etc.) and systems upgrades (HVAC, plumbing, electrical, etc.). Households of all ages are much more inclined to hire professional contractors for these projects, so the project mix is a critical factor in determining the DIY share.

Opportunities presented by the pandemic

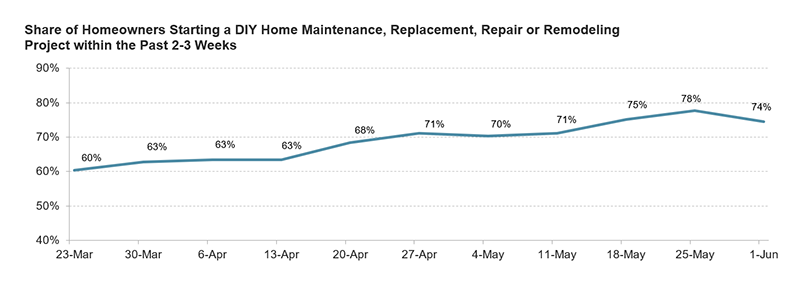

Rather than turning homeowners into a new generation of handymen and handywomen, the pandemic has presented the opportunity for many to make progress on their longstanding “to-do” list of home improvement and maintenance projects. Over 71 percent of owners undertaking DIY projects during the pandemic report that they had planned these projects prior to the pandemic. Most of the DIY projects undertaken have been relatively simple discretionary tasks where owners could devote some of their newfound time to sprucing up their home, given that they were spending more time there. The most common projects reported have been lawn maintenance, landscaping, painting and decorating, and general home maintenance (Figure 3), not only relatively simple projects, but ones that reflect the increased outdoor orientation of many households.

Figure 3: DIY Projects Owners Plan to Undertake in Near Future Are Generally Smaller Scale

Notes: Based on weekly homeowner surveys conducted over the mid-March to early June 2020 period. Results based on pooled responses of almost 7,000 homeowners who responded that they are definitively or probably planning to start a DIY project over the next few weeks.

Source: JCHS tabulations of The Farnsworth Group-Home Improvement Research Institute, COVID Home Improvement Impact Tracker, 2020.

The pandemic has produced unique needs and opportunities for homeowners to undertake home improvement projects. Given concern about the health risks of bringing contractors or other service providers into their homes, many homeowners have been more inclined to undertake projects themselves. Still, while owners have been using the pandemic to tackle their home maintenance and improvement projects, there are no indications of a longer-term reversal in preferences of owners toward undertaking projects themselves, particularly larger and more complicated home improvements. Nevertheless, if the overall home improvement market continues to expand as strongly as it has in recent years, a declining share may still produce overall growth in DIY spending levels.