A Triple Pandemic? The Economic Impacts of COVID-19 Disproportionately Affect Black and Hispanic Households

As a result of the COVID-19 pandemic, Black and Hispanic households have been more likely to lose income and experience difficulty making rent or mortgage payments, according to our analysis of data from the Census Bureau’s new weekly Household Pulse Survey (HPS).

Our analysis draws on data collected between May 21 and 26 in this weekly survey, which asked nearly 89,000 respondents about their social and economic situations since March 13, 2020, when lockdowns and restrictions began in many states. As discussed in our previous blog, despite its name, the HPS currently presents information on impacted individuals (not households), which may overstate the pandemic’s household-level impacts and makes it difficult to interpret some results. To address this issue, we calculated household-weights and produced household-level estimates.

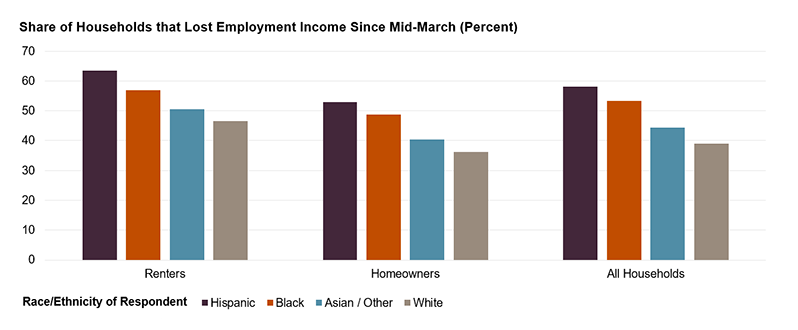

Using this approach, we found that Black and Hispanic households are much more likely to have been hurt by the economic impacts of COVID-19. More than half of Hispanic (58 percent) and Black (53 percent) households experienced a decline in employment income since mid-March, much higher than the share of Asian/other ethnicity (44 percent) and white (39 percent) households.

Moreover, renters were more vulnerable than homeowners: 52 percent of all renters had lost income from employment in the past two months compared to 39 percent of all homeowners (Figure 1) and Hispanic renters were hit the hardest. Almost two in every three Hispanic renters lost employment income (64 percent), followed by Black (57 percent), Asian/other (51 percent), and white (47 percent) renters. While renters were impacted the most, many homeowners also lost income. Among homeowners, Black and Hispanic homeowners were disproportionally impacted. About half of Hispanic (53 percent) and Black (49 percent) homeowners lost employment income since mid-March, compared with 40 percent of Asian/other ethnicity and 36 percent of white homeowners.

Figure 1: Minority and Renter Households Are More Likely to Have Lost Income as a Result of COVID-19

Note: The HPS household weight is a pseudo-household weight created by dividing the given person weight in the HPS by the number of adults in the household. Weights are used in survey research to make estimates derived from samples more representative of the population. White, Black and Asian/ other households are non-Hispanic. Hispanics may be of any race.

Source: JHCS tabulations of US Census Bureau, Household Pulse Survey, Week 4.

What explains these stark inequalities in COVID-19’s early economic impact? People of color, particularly Hispanics, were more likely to be working in low-wage jobs most vulnerable to furloughs and layoffs, especially in hard-hit industries such as leisure and hospitality, retail, and construction. In these jobs, people were least able to work from home, and the COVID-19 crisis turned some of them into frontline workers. There are many underlying causes for the overrepresentation of people of color in low-wage jobs, such as ongoing discrimination in hiring practices, economic exploitation of migrant workers, and the inheritance of a long history of segregation and blocked opportunity for African Americans in the US. Furthermore, renters are generally younger, have lower incomes, and are less likely to have a college degree—characteristics that have made them more vulnerable to income loss in the early months of the COVID-19 crisis.

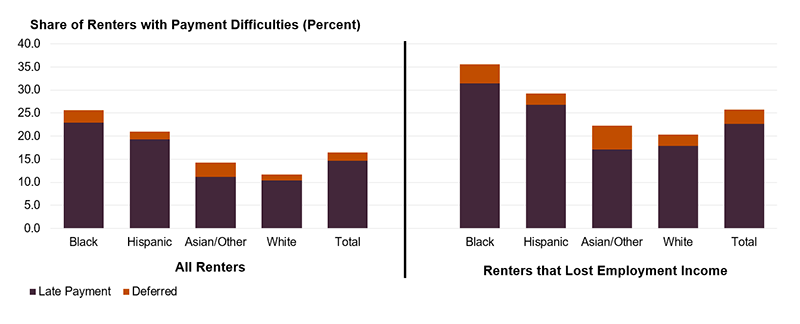

Consequently, millions of Americans now struggle to pay for their housing, despite government relief programs, such as the $1,200 CARES Act economic impact payment and the Paycheck Protection Program. Renters have struggled the most. Among all renter households, 15 percent did not pay their prior month’s rent on time and two percent deferred their payment (Figure 2). Among renters who lost employment income since mid-March, a full 23 percent were late on their rental payment, while three percent deferred. Black and Hispanic renter households were especially affected. Of all Black renters, almost a quarter were unable to make their prior month’s payment on time. Among Black renters who lost employment income, more than a third—35 percent—deferred or were late with their payment.

Figure 2: Renter Households Struggled to Pay Their Rent, Notably Black and Hispanic Renters, and Few Received a Deferment

Note: The HPS household weight is a pseudo-household weight created by dividing the given person weight in the HPS by the number of adults in the household. Weights are used in survey research to make estimates derived from samples more representative of the population. White, Black and Asian/ other households are non-Hispanic. Hispanics may be of any race.

Source: JHCS tabulations of US Census Bureau, Household Pulse Survey, Week 4.

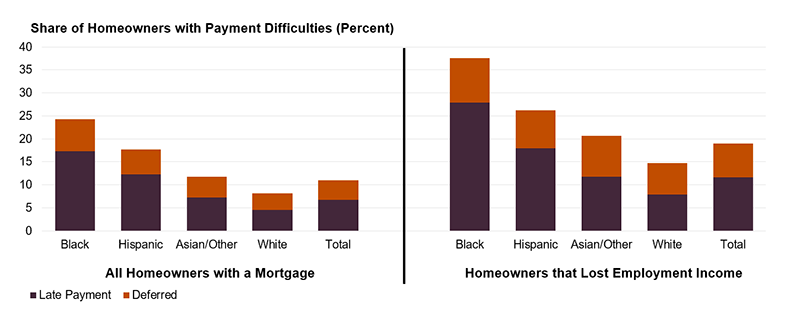

Struggling homeowners were more often able to defer their payments, as millions of homeowners with federally-insured mortgages can enter forbearance programs to receive temporary relief from paying their mortgage. Indeed, according to the lending data analysis company Black Knight, as of June 2, up to 9 percent of all mortgages received a forbearance. About half of these owners kept making payments in April anyway, a quarter made payments in May, and just 15 percent made payments by mid-June. According to HPS data, 7 percent of all homeowners with a mortgage did not make their mortgage payment on time, and an additional four percent deferred their payment. Among homeowners with a mortgage who lost employment income, 12 percent were late on their mortgage payments, and an additional 7 percent deferred their payment.

Minority homeowners were more likely to have trouble paying their mortgage. For instance, 17 percent of Black homeowners were late on their mortgage payment in the prior month and an additional 7 percent deferred their payment. By comparison, 5 percent of white homeowners were late, and an additional four percent deferred their mortgage payment (Figure 3). Minority homeowners were also less likely to receive a deferment than white homeowners. Among homeowners who struggled with their payment—either by being late or receiving a deferment— 44 percent of distressed white homeowners received a deferment, compared with only 31 percent of distressed non-white homeowners.

Figure 3: Black Homeowners in Particular Struggled to Pay Their Mortgages, Especially Those Who Lost Income

Note: The HPS household weight is a pseudo-household weight created by dividing the given person weight in the HPS by the number of adults in the household. Weights are used in survey research to make estimates derived from samples more representative of the population. White, Black and Asian/ other households are non-Hispanic. Hispanics may be of any race.

Source: JHCS tabulations of US Census Bureau, Household Pulse Survey, Week 4.

While hardships caused by COVID-19 have affected almost all Americans, these impacts are felt unequally. Black and Hispanic households have been much more likely not only to contract COVID-19, but also to suffer from lost income and face housing insecurity as a result of the pandemic. Two core policy priorities follow from our findings.

First, rental assistance is necessary to keep many renters in their homes. Fully 16 percent of renter households were late on or deferred their rent payments in May. For many of these households, the outlook is even more grim. Fully 30 percent of renters have no or slight confidence that they’ll be able to pay next month’s rent, including 44 percent of those who have experienced a decline in income. While many homeowners can secure temporary relief through forbearance agreements, many renters face the prospect of eviction after missing a single month’s rent. The federal government and some cities have instituted eviction moratoriums, but they apply only to a small percentage of renters, such as those in federally financed rentals. However, many federal and local eviction moratoriums, plus many of the federal government’s stimulus programs, are set to expire in July. If renters do not receive additional support until the current crisis abates, states across the country could see enormous increases in hunger, eviction, and homelessness. Black and Hispanic renters are especially at risk.

Second, other forms of assistance, through cash transfers or the continued supplement of unemployment benefits, would secure the housing of both renters and homeowners in distress. Black homeowners are especially vulnerable—more than one in every three Black homeowners who lost employment income struggled to pay for housing last month. Moreover, Black homeowners often have less equity in their houses to use as financial buffer in a crisis, compared to white homeowners. Given protections and reforms in financial markets since the last recession, the gross eradication of Black wealth and property ownership witnessed in the previous recession is unlikely to be repeated. However, the current crisis again disproportionally threatens Black, as well as Hispanic, homeowners. Federal, state, and local policy should pay special attention to this vulnerable group and put measures in place to prevent foreclosures.