Pandemic Leaves Many Remodelers Concerned About Revenue and Survivorship

Most residential remodeling firms experienced reduced business activity during the first three months of the COVID-19 pandemic, according to our analysis of weekly surveys done by The Farnsworth Group and the Home Improvement Research Institute (HIRI). The surveys show that the slowdown has been particularly intense for smaller firms, newer firms, and those that specialize in interior work.

There are a number of reasons why professional remodeling work slowed due to the pandemic. Health and safety precautions prompted both homeowners and firms to pause existing remodeling projects, while massive economic uncertainty discouraged owners from new spending. State-level shutdowns in response to the pandemic necessitated closing building departments and halting residential construction. Existing home sales—a leading driver of remodeling activity, as owners make investments and repairs in preparation for sale as well as customization after purchase—fell sharply in the months of March, April, and May, further pinching the remodeling market.

There are many unanswered questions about what effects, temporary and permanent, this pandemic will have on residential remodeling firms. Data from a new Farnsworth/HIRI weekly survey fielded between March 23 and June 1 can be used to answer three important questions: how much has remodeling work slowed; what types of remodelers have been hit the hardest; and what are the short-term and long-term viability of residential remodeling firms?

1. How much has work slowed for residential remodelers during the pandemic?

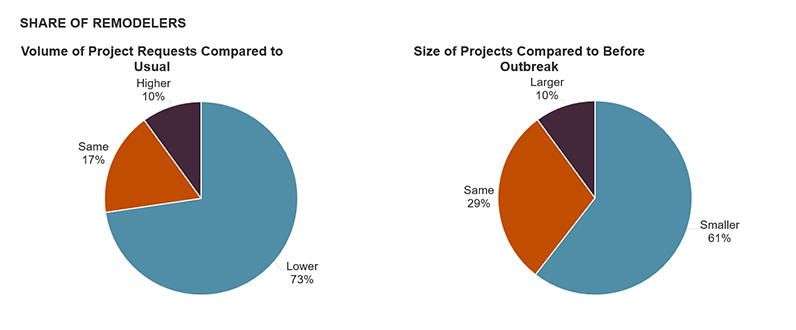

Between late March and early June, residential remodelers experienced fewer project requests, reduced project sizes, and stopped or delayed project completions. For the purposes of this analysis, “residential remodelers” are defined as contractors that conduct at least 50 percent of their work on residential remodeling. Over the eleven-week survey period, 73 percent of home remodelers reported lower than normal project requests, and 61 percent of remodelers said that current projects were smaller than before the COVID-19 outbreak (Figure 1). Fully 85 percent of residential remodelers reported that at least some of their work had been delayed or stopped because of impacts associated with COVID-19. Most of these remodelers (70 percent), however, expected projects to remain delayed for 3 months or fewer.

Figure 1: Remodelers Are Reporting Fewer Project Requests and Smaller Project Sizes Than Before Pandemic

Notes: Aggregated responses from 3/23/20 – 6/1/2020. Sample of 2,229 respondents.

Source: JCHS Tabulations of The Farnsworth Group-Home Improvement Research Institute, Weekly COVID Impact Tracker, Spring 2020

2. What types of remodelers have been hit the hardest?

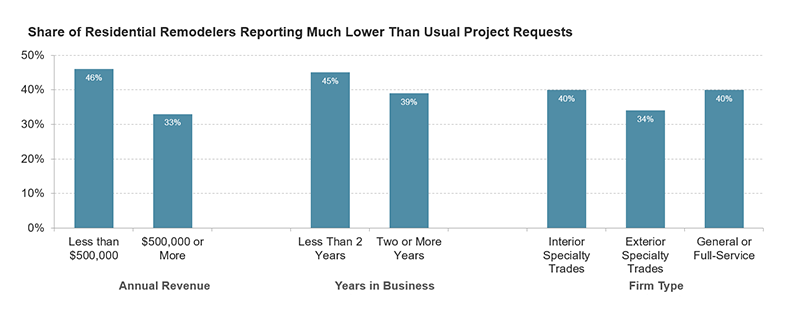

Firms with less revenue, newer firms, and firms that specialize in interior work have been more likely to struggle during the pandemic, seeing relatively fewer requests and smaller projects this spring compared to larger firms, more established firms, and remodelers focused on exterior replacements. Certainly, smaller and less experienced remodelers are less likely to have the resources to weather poor business conditions, while remodelers working on home interiors likely suffered from concerns about health and safety. Among the 84 percent of residential remodelers who reported feeling somewhat or extremely concerned about COVID-19 negatively impacting their business over the coming weeks, 64 percent cited the health and safety of themselves and their staff as their top concern. Ongoing concerns about health and safety on behalf of both contractors and homeowners may cause continued slowdowns in professional remodeling, especially for interior work where it is more difficult to maintain distance from others.

Figure 2: Smaller Firms, Newer Firms, and Interior Specialty Trades Report Much Lower Project Requests Than Usual

Notes: Aggregated responses from 3/23/20 – 6/1/2020. Sample of 2,229 respondents. Interior specialty trades include plumbers; electricians; HVAC installers; carpenters; painters; flooring, tile, and drywall installers; and kitchen/bath specialists. Exterior specialty trades include window/door installers, roofers, siding installers, landscapers, and decking and fence installers.

Source: JCHS Tabulations of The Farnsworth Group-Home Improvement Research Institute, Weekly COVID Impact Tracker, Spring 2020

The decrease in requests for projects varies by characteristics of the firm (Figure 2). Firms with an annual revenue of less than $500,000 were more likely to report many fewer project requests this spring than firms with an annual revenue of $500,000 or more. Nearly half (46 percent) of these smaller firms reported much lower than normal project requests, in comparison to 33 percent of larger firms. Similarly, in comparison to firms in business for two or more years, of which 39 percent reported substantially fewer than usual requests, 45 percent of newer firms reported much lower project requests.

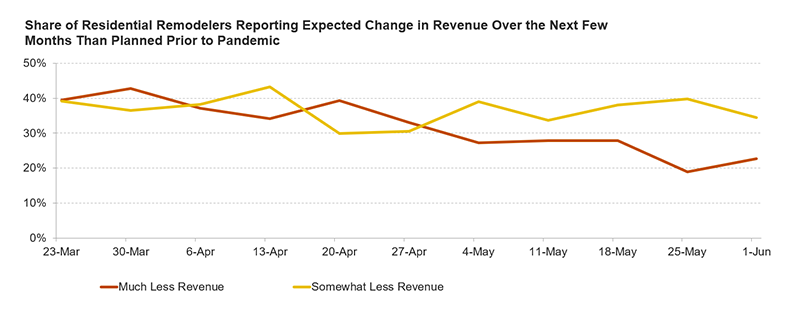

3. What are the near-term prospects for remodeling contractors?

The vast majority of residential remodelers surveyed between late March and early June—69 percent of the aggregate sample, or 1,536 respondents—expected less revenue in coming months than they had planned for prior to COVID-19, with nearly a third (32 percent) anticipating much less revenue. On a positive note, though, over the course of the survey period, the share of remodelers expecting much less revenue in the coming months decreased significantly from about 40 percent in March to 23 percent by the first week of June (Figure 3).

Figure 3: By Early June, Remodelers Were Less Pessimistic About Future Revenue Expectations

Notes: Aggregated responses from 3/23/20 – 6/1/2020. Sample of 2,229 respondents.

Source: JCHS Tabulations of The Farnsworth Group-Home Improvement Research Institute, Weekly COVID Impact Tracker, Spring 2020

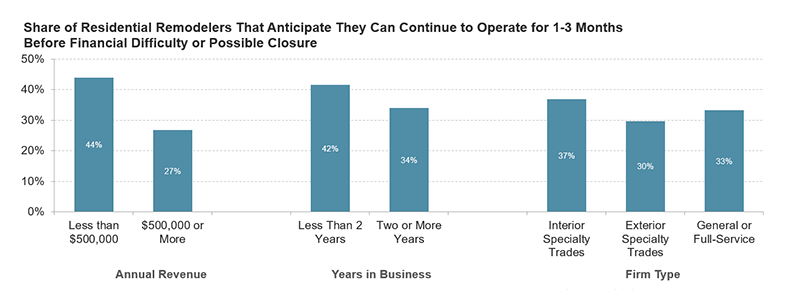

While the share of remodelers anticipating large decreases in revenue over the next few months has fallen, any realized losses in revenue will inevitably cause some firms to close. Of the residential remodelers anticipating somewhat or much less revenue over the coming months than planned for, more than a third (34 percent) estimated they could continue to operate for only 1-3 more months before financial difficulty or possible closure and only 8 percent reported that they could operate normally for a year or more at a lower revenue.

Figure 4: Large Shares of Smaller, Newer, Interior-Focused Remodelers Anticipate Hardship or Closure Within Three Months if Revenues Do Not Rebound

Notes: Aggregated responses from 3/23/20 – 6/1/2020. Sample of 1,536 respondents who responded that they anticipated decreases in revenue. Interior specialty trades include plumbers; electricians; HVAC installers; carpenters; painters; flooring, tile, and drywall installers; and kitchen/bath specialists. Exterior specialty trades include window/door installers, roofers, siding installers, landscapers, and decking and fence installers.

Source: JCHS Tabulations of The Farnsworth Group-Home Improvement Research Institute, Weekly COVID Impact Tracker, Spring 2020

Larger shares of smaller firms, newer firms, and interior specialty trades report a very short time horizon for how long they can continue to operate at lower revenue levels before their business is impacted by financial difficulty or closure (Figure 4). 44 percent of firms with a revenue under $500,000 reported that they could only operate for 1-3 months before financial difficulty or possible closure, in comparison to 27 percent of firms with a revenue of $500,000 or higher. Similarly, 42 percent of firms in business for less than two years estimated being able to operate for only 1-3 months before financial hardship or closure, in comparison to 34 percent of more established firms.

These survey results have several implications for the home remodeling industry. Earlier research found that remodeling contractor failure rates are relatively high even during periods of strong market growth, and smaller and newer firms typically see failure rates several multiples higher than larger, more established remodeling companies. And while the number of new daily COVID-19 cases in the US decreased slightly over the survey period, the number of new cases has since increased dramatically. Once health and safety conditions do improve and physical distancing requirements ease for remodelers and clients, it is likely that consumer demand for professional remodeling work will rebound. Yet, with a double-digit national unemployment rate, many homeowners may have reduced discretionary spending capacity for some time. Indeed, our COVID-adjusted 2020 Metro Area Home Improvement Projections forecast declines in remodeling activity in over half of major metros this year, and our latest Leading Indicator of Remodeling Activity projects annual home improvement and repair spending will also decline nationally by the second quarter of 2021.